1367 episodes

On Thursday, Feb. 12, the Environmental Protection Agency announced the revocation of the “endangerment finding,” a federal determination that planet-warming emissions harm human health. The Trump administration said the decision will save Americans $1.3 trillion in energy and transportation, but experts are pushing back on that claim. Plus: The rise of concierge medicine and a look into how AI modeling could play a role in your weather forecast.

When high earners ramp up their spending while low earners pull back, that’s a symptom of a "k-shaped" economy. But what about middle-income households? New evidence shows the middle class is also struggling in comparison to the wealthiest Americans. It’s sort of like a K shape within a K shape. After that: Newer firms are more likely to offer work-from-home options, Opera America has financial reasons for splitting from The Kennedy Center, and we check in with a few small businesses ahead of an upcoming inflation report.

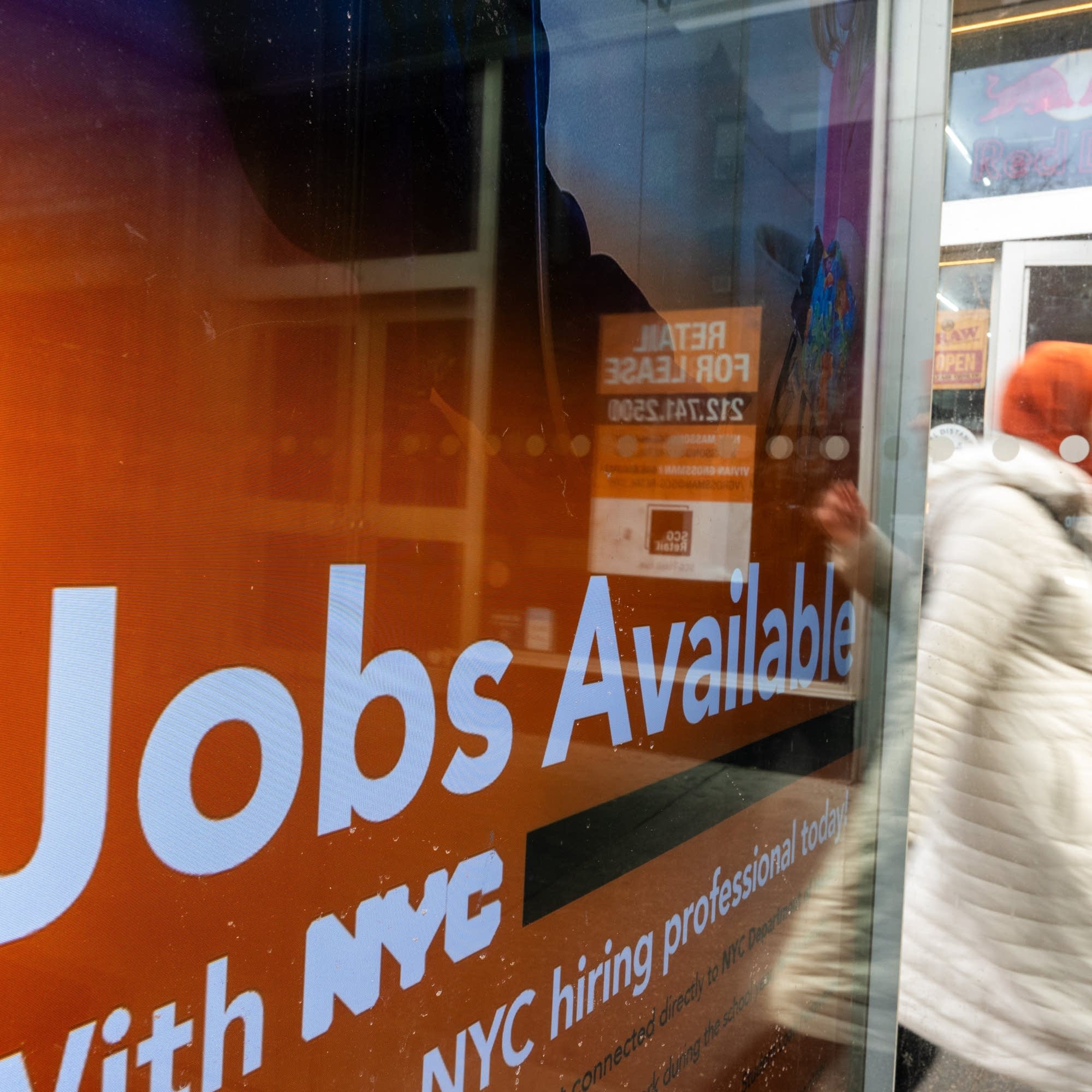

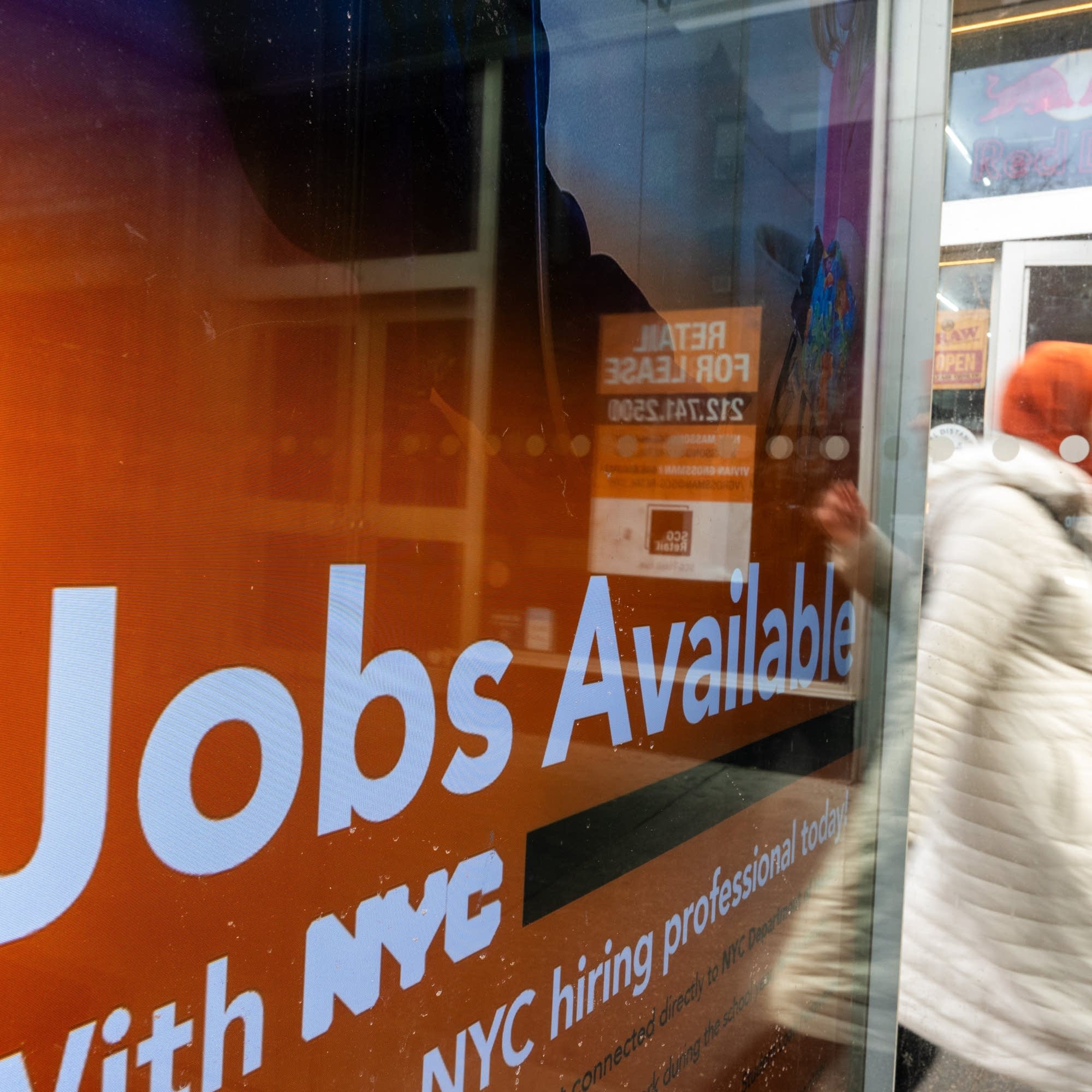

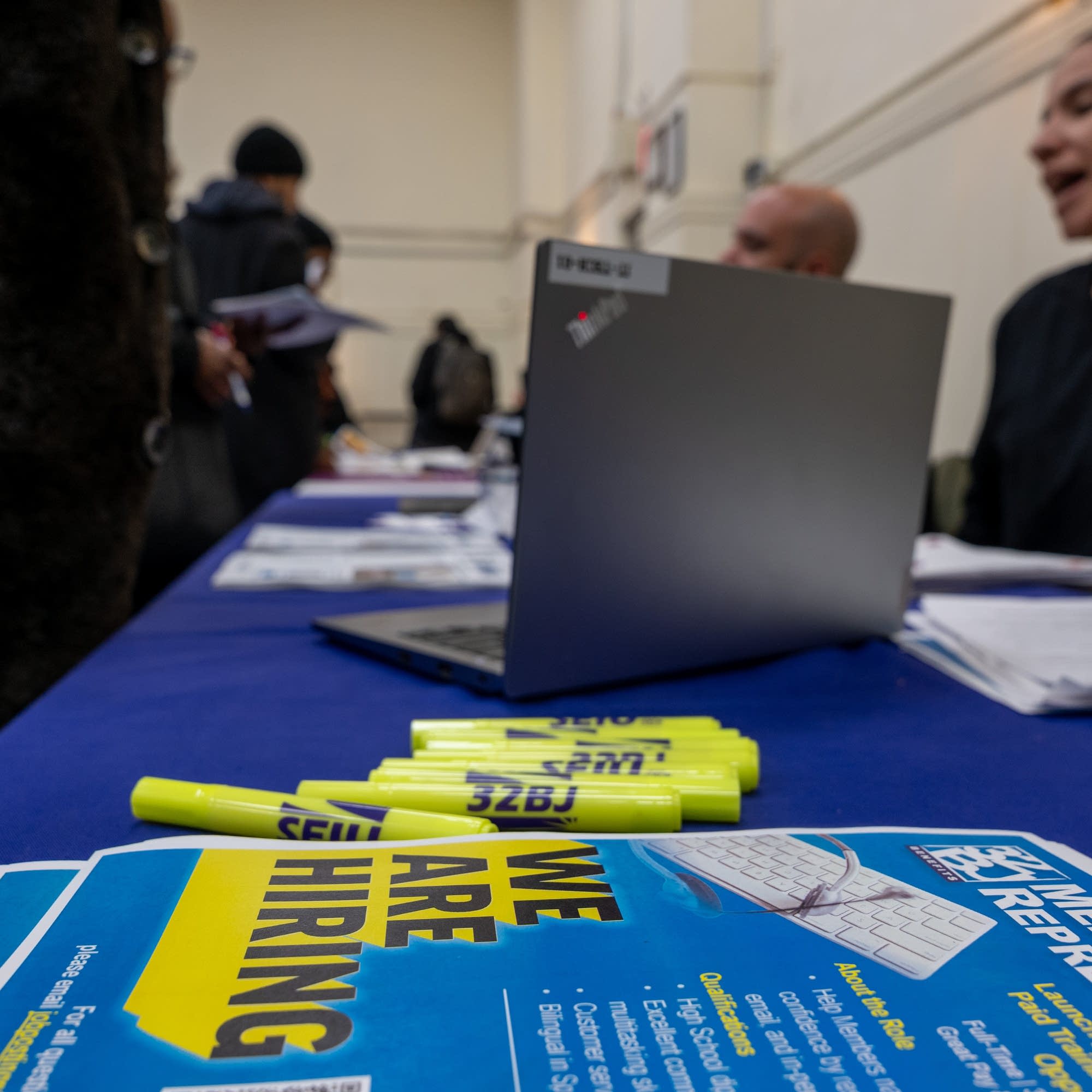

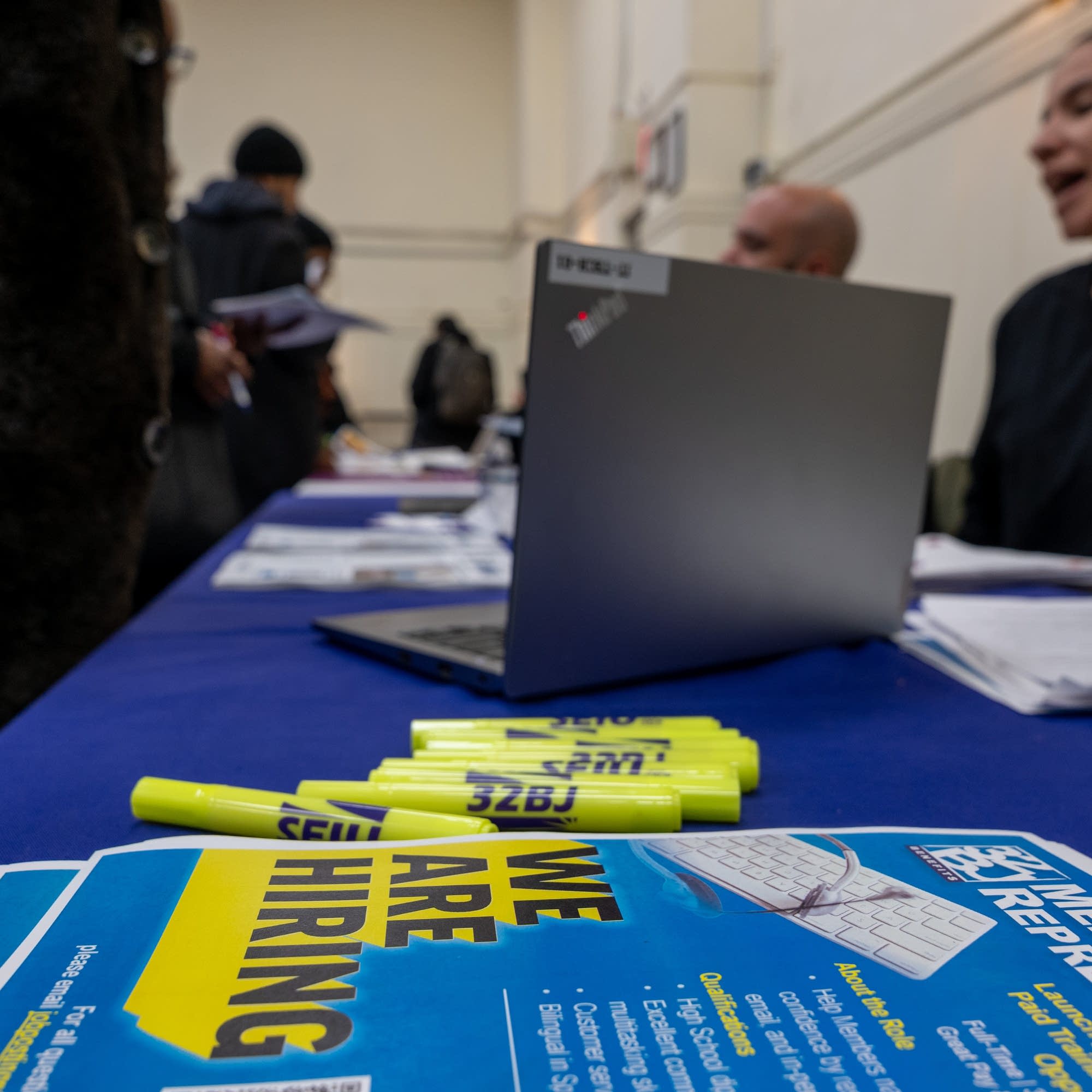

The January jobs report came out Wednesday, and on the surface, it was better than expected. The economy added more jobs than it has in months and the unemployment rate remained stable. But topline numbers don’t tell the whole story. After that: Trump’s immigration policies weigh on the labor market, Iran tensions cause choppy oil prices, and a new law brings whole milk back to school lunch programs.

New data show retail sales were flat in December, despite high expectations for the holiday season. So did shoppers spend less? Or did they just frontload that gift spending in November? Also in this episode: AI tools propel widespread online shopping scams, a Colorado utility company shuts off power to prevent wildfires, and what’s next for crypto after last week’s freefall.

On the whole, consumers are feeling 20% worse about the economy than they were a year ago, according to the University of Michigan Surveys of Consumers. High prices were cited as one concern, but that’s been a pain point for years. So what’s new? Also in this episode: Uncertainty in the tech sector drums up investor interest in consumer staples, the federal government yanked over 3,000 data sets from public sites under President Trump, and a dancer-educator discusses the business of ballet.

The latest JOLTS report is bleaker than expected. There were 6.5 million job openings across the U.S. economy in December, down nearly 400,000 from the previous month. This misaligned labor market is especially prominent in the services sector. In this episode, what's next for employment and which groups in particular are struggling to find work. Plus: The U.S. lags behind China in electrical capacity expansion, bankers show reluctance to lend to AI-impacted industries, and a photographer installs free-to-use phones across his city.

“Retail theft” often conjures Hollywood-esque heist scenes or sleight of hand at self-checkout. But 2025 was likely the biggest year on record for another, less glamorous kind of shrinkage: cargo theft. In this episode, how goods stolen right out of a truck raise costs for producers, logistics firms, and yes, consumers. Plus: More data centers plan to build their own natural gas plants, private sector data shows labor market growth is slow but steadying, and Kai visits an award-winning chef in South Los Angeles.

It's a big week for major televised events: The Winter Olympics kick off Wednesday and Super Bowl Sunday is nigh. Brands used to save their biggest, splashiest ad for such a slot. But this year, firms are pulling out all the stops to avoid controversy, or so much as hinting at a current event. Plus: Disney shows CEO selection is tricky business, PepsiCo announces price cuts on key salty snacks, and retail construction booms in Texas.

Productivity — the rate at which companies make what they make, or do what they do — has been a reliably bright spot in this economy. But wage growth hasn’t kept up. In this episode, what’s hampering compensation growth while overall productivity rises at a clip? Plus: Is AI actually to blame for recent layoffs? Is rising global debt bad news? And, the partial government shutdown will delay crucial employment data.

Activists called for a nationwide shutdown of economic activity Friday, Jan. 30, following another killing by immigration officials. But in this unforgiving economy, small business owners who support the cause faced a difficult decision. Today, a few told us how they navigated the moment. Plus: Sluggish big oil earnings show why Venezuela investment isn't popular, Trump announces his pick for Fed Chair, and parents pay a price for snow days.

Electricity prices have increased by approximately 40% since 2021, far outpacing inflation. Despite AI data centers making headlines as energy-suckers, that price growth comes from a multitude of factors — including upticks in demand and aging infrastructure. In this episode, you aren’t alone in energy bill price hikes. Plus: Caterpillar benefits from all that AI infrastructure investment, private equity eyes a new form of health care, and salary “lowballing” in a tough job market may be tempting.

We keep hearing how the U.S. dollar has been “weakening.” Put another way, the euro is getting stronger: It hit $1.20 earlier this week. But the language is a bit misleading — a stronger euro isn’t necesarily good news for people living in the European Union. In this episode, how currency fluctuation can mess with delicately balanced trade. Plus: Consumer confidence fell sharply among older Americans, the Federal Reserve held rates steady, and we checked in with a few businesses ahead of the Supreme Court decision on Trump’s tariffs.

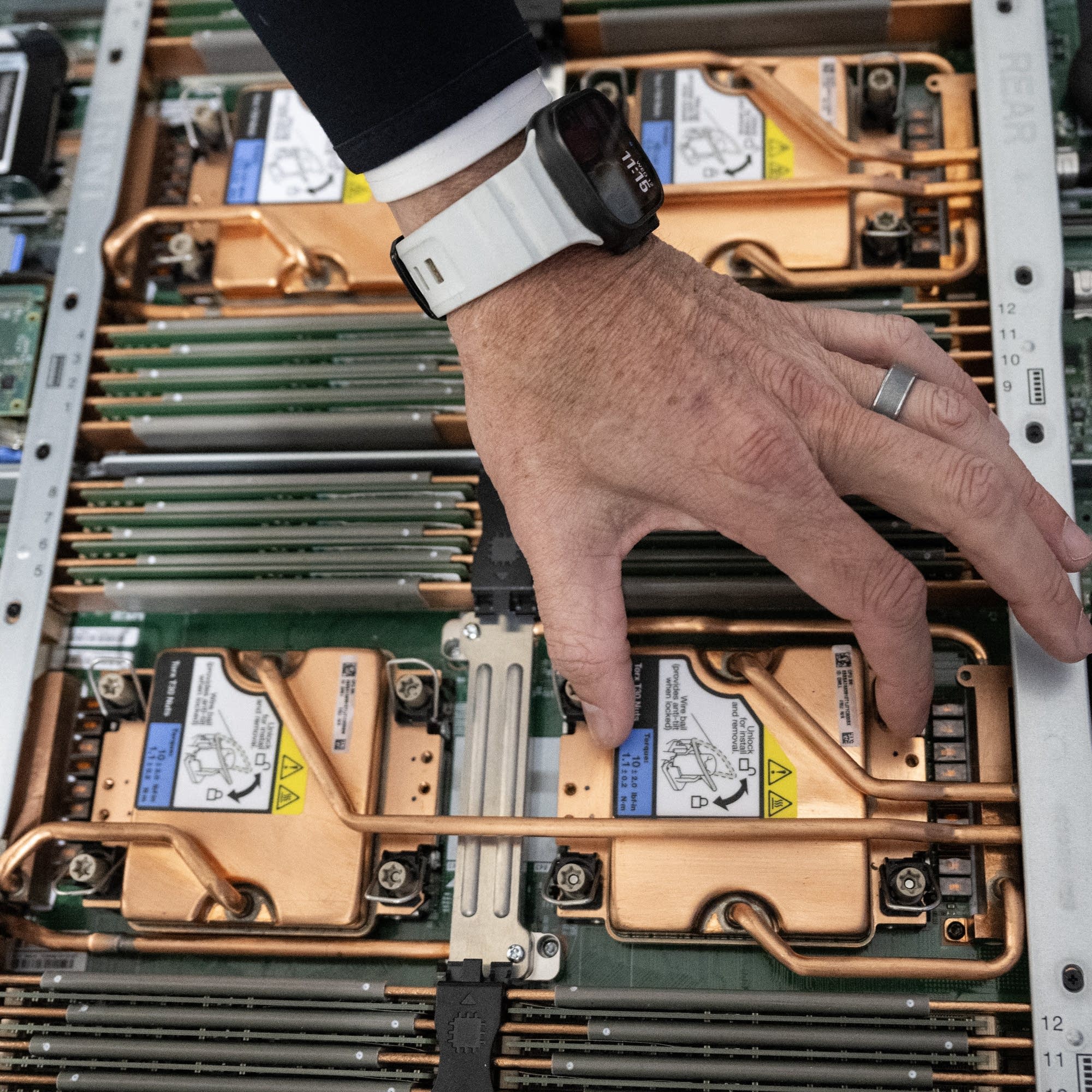

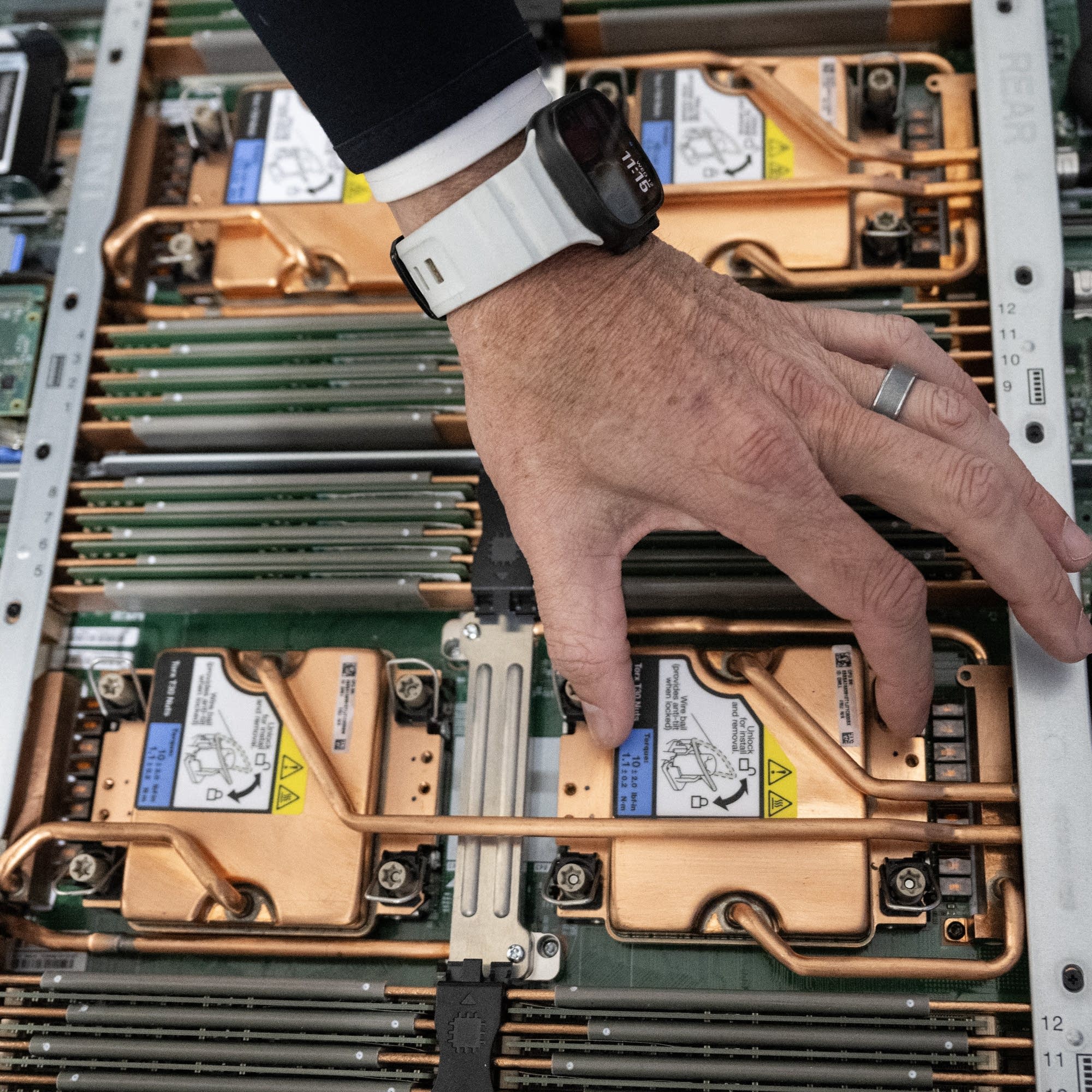

Artificial intelligence companies raised enormous amounts of money in 2025, and made major investments in development and infrastructure. What’s next? To understand more about the role AI could play in our futures, “Marketplace” host Kai Ryssdal and “Marketplace Tech” host Meghan McCarty Carino visited an AI company and an AI data center in Silicon Valley. In this episode, the next phase of AI innovation won’t come without obstacles.

Artificial intelligence is one of a handful of industries propelling this economy forward. But as the sector explodes, not everyone is on board. Americans are much more concerned about the downsides of AI than excited about its potential utility, according to a new Pew Research survey. In this episode, everyday Americans grapple with — and in some cases, fight back against — the proliferation of AI technology. Plus: Durable goods orders were up in November, gold prices continue to break records, and “Marketplace” host Kai Ryssdal tours a data center in Los Angeles.

The FDIC has approved proposals by GM and Ford to launch their own banking units. That means the automakers will be able to provide their own auto loans to customers. In this episode, a confluence of market conditions drove Ford and GM into banking. Plus: The Super Bowl of livestock shows highlights high cattle prices, changes to online search behavior affects digital ad revenue, and “Marketplace” host Amy Scott talks to Jordyn Holman at the New York Times and David Gura at Bloomberg about the week’s economic headlines.

Revised GDP data for this past summer shows the U.S. economy grew faster than we initially thought. A few key parts of the private services sector propelled that growth. In this episode, which parts of the economy are actually doing pretty well. Then: Gap leans in to “fashiontainment,” packaging costs weigh on food prices, and elderly care facilities stand to lose critical employees when TPS ends for Haitian immigrants.

The EU owns $8 trillion in Treasurys. Sure, Eurozone governments probably won’t use ‘em as leverage in the Trump-Greenland situation — and even if they wanted to, it’d be complicated — but what if they did? We’ll explain. Also in this episode: United posts strong quarterly profits after a turbulent year, a primary care doctor tells Kai how Medicaid changes are affecting his work, and cover crops are a tough sell for cash-strapped farmers.

After decades of globalization, the U.S. may be paying a political price: International leaders are forging new trade agreements independent of American influence. In this episode, as some countries no longer see the U.S. as a reliable trade partner, will the global economy leave America behind? Plus: Sellers outnumber buyers in parts of the housing market, Georgetown’s Dorothy Brown discusses her new book about reparations, and we preview Fed governor Lisa Cook’s upcoming Supreme Court hearing.

President Trump has announced new tariffs on European Union countries, aimed at forcing a deal for the U.S. to acquire Greenland. But the EU could respond relatively quickly, with sanctions of their own. In this episode, the EU’s “bazooka” option. Plus: Trump’s recent housing proposals won’t fix the fundemental issue driving housing affordability, technology has changed how parents dole out kids’ allowance, and we explain the history of economic jargon.

An AI-driven construction boom is coming, some hope. But to build all that infrastructure, the U.S. is going to need a lot more construction workers, plumbers, HVAC technicians, and other skilled workers. And President Trump’s immigration policies actively work against that goal. Also in this episode: Trump withdraws the U.S. from a key global climate change agreement, Americans shell out for at-home coffee setups, and Kai discusses the week’s economic headlines with Greg Ip at the Wall Street Journal and Amara Omeokwe at Bloomberg.

President Trump recently ordered government-backed mortgage companies (that’s Fannie Mae and Freddie Mac) to buy up $200 billion in mortgage-backed securities. The last time they bought these bonds was the 2008 financial crisis. Will the move actually lower rates? Probably not much. Also in this episode: Venture capital can thank AI for a 2025 rebound, banks fight to block stablecoin interest yields, and more young people are getting prenups.

The unemployment rate in December among people aged 20 to 24 was 8.2%. That’s up nearly a full percentage point from 2024, and much higher than the overall unemployment rate of 4.4%. The job market is tough, and getting tougher, but why is it particularly hard for Gen Z? Also in this episode: Trump’s focus on Venezuelan crude could redirect Canadian oil, companies use surveillance data for “personalized” pricing, and China’s trade surplus grew by 20% last year, in spite of U.S. tariffs.

The cost of food consumed at home was up 0.7% month-over-month in December, and 2.4% year-over-year. Go back five years, and grocery prices are up 25%. And like so many things in this economy, the rising cost hurts the poorest Americans most. Also in this episode: Americans carry credit card debt longer than they used to, two ultra-low-cost U.S. airlines make plans to merge, and we get an update from Kansas grain farmers.

The Department of Justice has opened an investigation into the Federal Reserve and Chair Jerome Powell, a move Powell has since called "an unprecedented action [that] should be seen in the broader context of the [Trump] administration's threats and ongoing pressure" to lower interest rates. We take a closer look at what’s happening from inside the Fed, and look at the implications for the economy as a whole.

The rate of jobless Americans who’ve been out of work for over 27 weeks — also known as “long-term unemployed” — hit 26% in December, according to the latest jobs report. That’s the highest it’s been since February 2022. In this episode, why the rate is rising and what it says about the broader economy. Plus: Businesses curb 2026 growth plans, a farmer discusses AI in agriculture, and we check in with an Asheville, North Carolina, tea company over a year since Hurricane Helene.

The January jobs report and consumer price index come out this week, and experts expect both employment and inflation to hold relatively steady. But that jobs report will also include revisions to 2025 data. Will that show a net loss of jobs over the last year? Also in this episode: Foreign investment in U.S. Treasurys stays strong, Hollywood prepares to renegotiate key labor agreement with SAG-AFTRA, and Michigan wants to sue Big Oil for antitrust violations.

Labor economists will tell ya, productivity growth leads to more hiring. The idea is, once a company is operating more efficiently, they’ll try expanding, which usually comes with new jobs. But in this frustrating and bizarre economy, data show major productivity gains and a stagnant labor market … coexisting? Also in this episode: New York City expands a free child care program, one reporter tries to do the job(s) of the federal government, and economists expect a less-grim December jobs report.

The job market has been steadily losing steam and workers have noticed. Though the unemployment rate remains fairly low, some groups are experiencing heightened job-finding trouble, and overall employment sentiment is falling. In this episode, are job market worriers paranoid or prophetic? Plus: Nvidia CEO announces new AI chips won’t require as-expensive cooling systems, car sales were up in 2025, and economists study why new tariffs haven't dinged the economy much — yet.

This year, amid ongoing economic uncertainty, corporations are expected to refinance old debt, invest in artificial intelligence, and prep for mergers and acquisitions. All of which require extra cash. And how do corporations stretch their budgets? By taking on more debt, of course. Later in this episode: An Altadena small business owner struggles to rebuild after the LA fires, Texas pitmasters weigh rising brisket prices, and Costco converts wine snobs.

Disruptive geopolitical events often push investors to jump into bonds or sell off stocks temporarily. But when the U.S. military captured Venezuelan leader Nicolás Maduro and President Trump declared control over the oil-rich nation, neither of those happened. In this episode, markets are largely unmoved by Trump’s military intervention. Plus: Experts say jobs data is most important for predicting where the economy is headed, and Landon Derentz at the Atlantic Council Global Energy Center gives context to Venezuela’s oil infrastructure.