2018 episodes

Jason emphasizes the importance of the rental market and direct investment in rental properties, highlighting the potential for stable income and tax advantages. He also discusses the recent trends in rental increases across the US, indicating some markets like Phoenix as challenging due to oversupply. Lastly, he promotes the upcoming empowered investor cruise, with limited availability, and advises on booking options. We also really would appreciate it if you would rate and share our show! #RealEstateInvesting #RentalProperty #InvestmentOpportunity #IncomeProperty #PropertyMarket KEY TAKEAWAYS: 1:31 Shadow demand and the undersupply of the housing market 4:36 Event at Mar-a-lago Club with Kari Lake 6:01 3rd commandment of successful investing: be a direct investor 9:34 No such thing as a passive investment 10:40 RESimpli.com/Hartman 14:17 Be an Empowered Investor Pro member 15:35 Sentencing the white collar crooks 16:30 Chart: Single family rents 18:02 The Top 40 Metro Areas in the US 21:43 The Multifamily market 24:15 Sign up for the Empowered Investor Cruise https://empoweredinvestorlive.com/ * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Today's Flashback Friday is from episode 988, published last April 16, 2018. Jason Hartman does this episode from the US territory of Puerto Rico, where he's spent a few days seeing if he wants to live in this tax haven. The thing about Puerto Rico, however, is that while it might be a place with low tax, it's not a place with low real estate prices. Then, Jason talks with Jake Bernstein, author of Secrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global Elite, about what the Panama papers are, why they're important, and what kind of impact we should expect to feel from the fallout. Want to know why tax revenues are low, how governmental agencies have been paying spies for years, or more on the Rothchild family? Listen in to learn how the Panama papers can help you find out. KEY TAKEAWAYS: 4:50 Puerto Rico real estate is NOT cheap 7:10 Join Jason in Philadelphia for the Creating Wealth seminar 10:17 What are the Panama papers? 14:13 Why do the Panama papers matter? 18:30 Jake isn't as optimistic as Jason about how much money the new tax reform will repatriate 21:36 Some of the scandals to be unearthed by the Panama papers 25:56 The CIA & IRS' involvement in the Panama papers 31:22 Is the Rothchild family in the Panama papers? WEBSITES: www.JakeBernstein.net http://www.jakebernstein.net/ Secrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global Elite * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason discussed various topics related to the housing market, including current and forecasted mortgage rates, the ongoing inventory shortage, and the state of the multifamily housing market. He also addressed the issue of housing affordability, arguing that it is not a necessary condition for a healthy market, and shared his own experiences in the market. Lastly, he touched on the impact of climate-induced inflation on food prices and overall inflation rates, and endorsed his inflation-induced debt destruction strategy with income properties. And in part 2 of Jason's interview with Rick Sharga, Rick delves into the housing market, highlighting mortgage rates near 20-year highs affecting purchase loan applications and pending home sales due to decreased affordability. He anticipates gradual mortgage rate declines attracting more buyers than sellers, likely resulting in increased competition and rising prices. Existing home sales show a 6.5% year-over-year price increase, while new home prices have decreased by 15% from peak levels. Investor purchases remain robust, primarily driven by individual investors rather than institutions. Flipping activity has declined due to pricing challenges, but gross profits are improving, indicating a potential resurgence. #baselane #baselanehq #altosresearch #corelogic #CJPatrick #HousingMarket #MortgageRates #HomePrices #Inventory #Investors #RealEstateInvesting #RentalMarket #MarketTrends #PropertyMarket #Homebuyers #HomeSellers #EconomicIndicators #InvestmentOpportunities #HousingInventory #MarketAnalysis #HousingTrends #RentalProperties #FlippingProperties #MarketShifts #HousingAffordability #NewConstruction #RentalDemand #PropertyInvestment KEY TAKEAWAYS: 1:57 Forecast for the average 30-year fixed mortgage rate 4:29 Housing affordability and Interest rates 8:18 Massive distress 16:36 Overall economy 17:03 Housing market- mortgage rates still near 20-year highs 19:17 January sales up from December, but down from 2023 20:22 Inventory up 21% from last year 20:49 New listings up 15% from historically weak 2023 numbers 21:38 The rate lock effect 23:58 Home prices are up YOY in every region of the country 24:55 https://www.baselane.com/jason Link to our Instagram page - https://www.instagram.com/baselanehq/ 25:30 New home sales bounce back after declining late in 2023 27:56 New home prices down 15% from peak 30:15 Corelogic report: Investor share of home purchases continue to grow 31:01 Number of Flips down 30% from 2022 31:50 Even though gross margins appear to be improving 32:07 Reason for pessimism? Apartments vs. single family property 33:34 Delinquencies, foreclosures, distressed borrowers, equity protection 36:35 CRE distress continue to build, commercial foreclosures 37:16 Observations Baselane.com http://baselane.com/ is dedicated to empowering landlords and independent real estate investors with innovative financial solutions and banking built for their needs. Baselane services include banking, bookkeeping, rent collection, and financial analytics, all designed to streamline your property management and investment business. * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason discusses the surge in existing home sales by 9.5% in February, marking a two-year consecutive increase due to a slight rise in inventory. Fox Business highlights keeping mortgage rates under 7% for homebuyers. The show emphasizes the housing affordability crisis and potential impacts of the NAR lawsuit on realtor commissions, predicting market chaos. Despite media misreporting on commission changes, the segment stresses the need for real estate professionals in navigating complex transactions. It anticipates increased competition among brokers and agents, urging them to enhance service quality amid evolving market dynamics. Then Jason welcomes real estate analyst Rick Sharga. Rick discusses the housing market and economic trends. Despite concerns of a crash, he suggests a slow period with modest price increases rather than a downturn. He dismisses crash predictions, highlighting historical data showing home prices generally rise during recessions. Sharga addresses factors like consumer spending, job growth, inflation, and Fed policies influencing mortgage rates. He acknowledges the possibility of a mild recession due to Fed actions but emphasizes it may not significantly impact real estate if inventory remains low and distressed sellers are scarce. #cnbc #foxbusiness #neilCavuto #RickSharga #RealEstateTrends #HousingMarket #HomeSales #MortgageRates #NARLawsuit #AffordabilityCrisis #MarketAnalysis #FoxBusinessInsights KEY TAKEAWAYS: 1:40 WSJ article: 9.5% surge home sales in FEB 3:11 Fox Business- over and under 7% supply/demand dynamics 14:49 Rick's macro view on the housing market 18:39 A different supply and demand dynamic 21:57 GDP remains strong, unemployment and other factors 24:55 https://RESimpli.com/Jason/ 26:37 Wage growth and consumer confidence & spending and the debt trap 31:49 Inflation and the FED 34:56 FED Funds rate, the Yield curve and avoiding a recession * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Today's Flashback Friday is from episode 979 published last March 27, 2018. Jason Hartman goes solo in today's episode, as he breaks down the flow of foreign money into the US real estate market and which states have benefited the most from that influx. He also explains why big business secretly loves some regulation, the shrinking of the welfare state (no matter how minimal it is), whether we're seeing signs of an economic letup, and more. KEY TAKEAWAYS: 4:15 Some stats on foreign buyers of US real estate from the National Association of Realtors 9:08 How much real estate investor money is coming in from some of the top countries like China, Canada & the UK 11:11 Which states have benefited most from foreign money recently? 13:38 There is, no surprise, a housing shortage going on right now 17:58 1984 is coming true, but not the way we all expected 21:28 Why big companies secretly want more regulation 26:07 Are there any signs of an economic letup? 30:03 The welfare state is getting reigned in a little bit 34:57 Households are dedicating 10% of after tax income at a lower rate than 5 years ago WEBSITE: www.JasonHartman.com/Events http://www.JasonHartman.com/Events www.JasonHartman.com/Properties http://www.JasonHartman.com/Properties * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason discusses the Hartman Risk Evaluator and the importance of investing in commodities for real estate investors. He highlights the significance of packaged commodities, such as lumber, concrete, and steel, in real estate investments. By analyzing the producer price index, He emphasizes how fluctuations in commodity prices affect the housing market and investor risk. Jason contrasts linear markets with cyclical ones, advocating for investing in stable, commodity-driven markets to mitigate risk. He stresses the long-term benefits of prudent investing over speculation, underscoring the reliability of linear markets. #RealEstateInvesting #CommoditiesInvesting #RiskManagement #HartmanRiskEvaluator #InflationHedge #LinearMarkets #CyclicalMarkets #HybridMarkets #InvestmentStrategy #MarketAnalysis #FinancialEducation #AssetDiversification #PropertyInvestment #FinancialLiteracy KEY TAKEAWAYS: 1:24 Risk Evaluator and packaged commodities investing 5:57 Producer prices up in Feb 10:52 Baselane.com/Jason 14:03 PPI: softwood lumber and other materials 17:20 3 types of markets and LTI ratio 23:55 What Zimbabwe can teach investors about jurisdictional diversification * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason discusses the unique characteristics of the US real estate market compared to other countries, focusing on mortgage market composition. He highlights the dominance of long-term fixed-rate mortgages in the US, contrasting them with variable-rate mortgages prevalent in other countries like Finland and Australia. He also touches on the impact of a recent settlement by the National Association of Realtors (NAR) in an antitrust lawsuit, predicting changes in the real estate industry, including potential industry-wide consolidation and the role of loan officers. He emphasizes the importance of this development for both industry professionals and consumers. Jason then welcomes Bill Faeth as they talk about Bill's entrepreneurial journey and his approach to creating wealth. Bill shares his experiences of founding 31 startups, dealing with different personalities in business, and the importance of aligning work and life. He emphasized the need for a mindset shift towards integrating work and life, and the need for intentional alignment with one's spouse. Bill also discussed the influence of a Fortune 500 CEO, on his life who introduced him to the concept of a life plan. He stressed the importance of being present in his life, especially with his family, and talked about auditing his success as a parent. https://www.billfaeth.com/ #RealEstate #USMarket #Mortgages #NARSettlement #IndustryConsolidation #LoanOfficers #AntitrustLawsuit #HousingMarket #Investing KEY TAKEAWAYS: 1:29 The special US real estate market 6:55 NAR $418M Settlement 13:51 Find buyers before agents 16:12 A chance for consolidation 19:23 Get on the waiting list for the upcoming Empowered Investor Cruise 20:27 Have a "life plan" 28:43 The angle of money and the idea of "enough" 31:27 https://resimpli.com/Jason/ 35:21 Why real estate 39:01 The future of real estate and timing the market * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

This Flashback Friday is from episode 100, published last May 19, 2009. Our world is desperate for leaders who serve and make an eternal difference in the lives of others every day. On this momentous 100th episode of , Jason Hartman interviews leadership expert, Dr. Jeff Myers, President of the Myers Institute for Communication and Leadership, and Passing the Baton International on this timely subject. The mission of Dr. Myers is to equip culture-shaping leaders to understand the times by providing tools and training that unleash their leadership gifts and enable them to communicate the truth with confidence. Jeff is the author of seven books and five video coaching systems including , and , a training curriculum used in schools around the world. More than two million people have used Jeff’s worldview, leadership, and communication training courses. Join in as we celebrate the 100 episodes of which Jason Hartman has recorded to give you, his listeners, the opportunity to learn cutting-edge investment strategies and advice needed in the world today! Upcoming shows will feature: buying with only $5,000 down, cutting-edge property tracking technology, and apartment riches with an expert from the American Apartment Owners Association (AAOA). * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason discusses the housing market and economic trends. He likens the market constrictor, symbolizing economic pressures, to a boa constrictor squeezing homeowners due to low mortgage rates. He criticizes California's tenant-friendly regulations, highlighting Santa Monica's extreme housing policies. He touches on inflation concerns, emphasizing the housing market's resilience amid inflationary pressures. The episode concludes with cruise updates and invitations to Zoom meetings. Jason offers tremendous insights into real estate investment strategies amidst market challenges. One last room available for the Empowered Investor Cruise!- unless you book a suite! Go to https://www.jasonhartman.com/ TODAY! Them finishing up his interview with Dean Rogers, Jason talks about how the real estate market is showing signs of a temporary slowdown, especially in the apartment sector due to oversupply. While rents are softening in apartments, single-family homes continue to see rising rents. Jason suggests a crash is not imminent, citing factors like historically low-interest rates during COVID and the high equity and credit quality of mortgage holders. With a shortage of entry-level homes and strong demand, the market remains stable. They advise focusing on income-producing assets like real estate, emphasizing the importance of sensible property investments and understanding multidimensional returns. Interest rate predictions are uncertain, but Jason recommends leveraging property tracker https://www.propertytracker.com/ for analysis. #RealEstateInvesting #MarketAnalysis #TenantRights #InflationInsights #PropertyInvestment #EconomicTrends #HousingMarket #LandlordTips #FinancialFreedom #InvestmentStrategies #EconomicOutlook #WealthBuilding KEY TAKEAWAYS: 1:20 Say 'hello' to my little friend 8:55 The socialist republic of Cali; invest in landlord-friendly states 12:54 Inflation reports 17:01 Only one room available on our Empowered Investor Cruise 17:29 The market's not going to crash-YET 19:52 Chart: percent of close-end, first-lien mortgages outstanding by interest 22:40 Chart: Mortgage originations by credit score 25:12 https://www.baselane.com/jason 25:48 https://www.propertytracker.com/ 28:19 Predicting interest rates 33:32 Action steps * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Today, Jason discusses the rise in median net worth from 2019 to 2022, adjusted for inflation, and how different demographics were affected differently. He then talks about the increase in home equity in the last quarter of 2023, attributing it to rising home prices. He also mentioned the current state of the market and encouraged listeners to register for the upcoming "Empowered Investor Cruise" event. Book your ticket NOW at https://www.jasonhartman.com/ Jason then gives an interview on the "Dean Rogers Show" as he discusses the economy and real estate market, emphasizing the importance of data-backed insights over sensationalism. Jason presents the concept of inflation-induced debt destruction, highlighting real estate's unique advantages. He discusses the government's strategy of inflating currency to manage debt, correlating it with real estate investment principles. He analyzes low inventory in the housing market, attributing it to favorable mortgage rates, and predicts a prolonged shortage due to cheap mortgage locks. He suggests opportunities in home remodeling and rental property investment amidst rising rents and declining homeownership rates. #WealthTrends2022 #HomeEquitySurge #EquityInsights #EmpoweredInvestor #IndianaCashFlow KEY TAKEAWAYS: 1:31 You're getting richer 6:07 Home Equity in 2023 8:00 Map: Average Equity Gain (YOY) and Negative Equity Share 10:57 Go on a 5-day cruise with us! Book your ticket NOW at https://www.jasonhartman.com/ 12:02 Join the Empowered Investor monthly meeting this Wednesday! Reach out to our investment counselors for details 12:27 Trained to look for the negative 15:51 Business plan of governments and central banks 17:47 Inflation-induced debt destruction 22:29 https://resimpli.com/Jason 24:06 Analysis: very low housing inventory * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

This Flashback Friday is from episode 958, published last February 13, 2018. Jason Hartman kicks off the show today asking his ultimate question: compared to what? It's a question that will serve you well in all aspects of your life and will guide you down the right path. He also wants to invite you to join him on any of his adventures scheduled for this year to make your vacation planning even easier. Then Jason wraps up his interview with Macro Watch's Richard Duncan. The two tackle the topic of rising interest rates, better uses for going into further debt than giving it to tax reform, how the Fed will react to a tanking stock market, and what we can expect to see over the next few years. #FlashbackFriday #RealEstateInvesting #FinancialIndependence #InvestmentTips #WealthCreation #EconomicAnalysis #TaxReform #GovernmentInvestment #FiscalPolicy #QuantitativeTightening #StockMarketVolatility #PropertyInvestment #GlobalEconomy #RichardDuncanEconomics KEY TAKEAWAYS: 4:06 Always view things in perspective, and remember, COMPARED TO WHAT? 6:45 Meeting fellow investors is crucial to success 8:12 Why doesn't Jason want you to plan any vacations this year? 12:07 Over Thanksgiving, while re-reading The Art of the Deal, Jason realized that Trump is a New York liberal 14:52 What people don't realize about interest rates "People buy houses on a payment, not a price" 16:04 What the Fed will do if the market drops 10% and what else will happen if it drops 20% 19:23 What Richard wishes the government had done with the $1 trillion in new deficits that will occur from the new tax reform 23:57 Why Richard thinks the government can invest as wisely as private companies 28:24 What are the next few years going to look like? 30:56 People need to get very familiar with quantitative tightening WEBSITES: www.RichardDuncanEconomics.com (promo code: GLOBAL for 50% off) www.JasonHartmanUniversity.com www.JasonHartmanIcehotel.com www.VentureAllianceMastermind.com * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason discusses insights from an investor meeting. He shares strategies for managing real estate portfolios, including 1031 exchanges, captive insurance, and cryptocurrencies. He then addresses historical reasons not to invest, spanning from economic crises to geopolitical tensions. Despite challenges like COVID-19 and inflation, income property remains resilient. He highlights ongoing concerns such as interest rates and market adjustments in 2023. Throughout, he emphasizes the enduring value of real estate as a historically proven and tax-favored asset class. Get ONE ON ONE coaching with Jason today! And PROTECT your assets! Visit JasonHartman.com/Protect to find out more! NEW lease offer option: Go to https://fireyourmanagers.com/ for more information! #RealEstateInvesting #InvestmentTips #PropertyMarket #FinancialAdvice #WealthBuilding #EconomicOutlook #ExpertInsights #MarketAnalysis #PropertyInvestment #JasonHartman KEY TAKEAWAYS: 1:18 Update on Empowered Investors monthly meeting 8:36 Baselane.com/Jason 14:26 Reasons not to invest in income property 23:01 Projecting this year's fears * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason discusses the staggering increase in the US national debt and its inflationary implications for investors. He emphasizes income property as a hedge against inflation, highlighting its indexed rents and assets. Hartman analyzes a property in Sarasota, Florida, presenting three financing options and their projected returns. Despite varying cash flow scenarios, he advocates for understanding the math behind real estate investments and suggests using tools like PropertyTracker for dynamic projections. Jason also encourages bringing laptops on his upcoming cruise for investment discussions. Secure your spot NOW at https://www.jasonhartman.com/ Then Jason and Paul Moore delves into the current state of commercial real estate, focusing on multifamily, office, RV and mobile home markets. They discuss the rise of rescue capital, which assists struggling deals, particularly in multifamily, where many properties are overpriced. They explore how office markets may never fully recover due to remote work trends and pandemic-induced lifestyle changes. They also touch on the impact of struggling office portfolios on banks, revealing a potential contagion effect. Overall, they suggest a nuanced understanding of the commercial real estate landscape is crucial amidst ongoing market shifts. #RemoteWorkRevolution #OfficeMarketTrends #PostPandemicWorkplace #CommercialRealEstateInsights #RemoteWorkImpact #IndustryAnalysis #OfficeSpaceInvesting #RealEstateOpportunities #AdaptToChange #FutureOfWork #OfficeMarketEvolution #WorkplaceTrends #OfficeRealEstate #EconomicDynamics #MarketAnalysis KEY TAKEAWAYS: 1:20 The US national debt 4:31 Lowest down - best leverage projection 8:35 25% down projection 10:36 Buy cash to existing loan 12:55 Learn to do the math https://www.propertytracker.com/ 14:48 Should I bring my laptop on the upcoming cruise? https://www.jasonhartman.com/ 16:34 The state of "commercial real estate" 20:38 Self storage 22:40 Multifamily 25:49 Rescue capital and pref equity 30:34 We Help Real Estate Investors Close More Deals https://resimpli.com/Jason/ 31:51 Office space and RV parks 39:30 RV parks and AirBnB https://rvshare.com/ https://www.outdoorsy.com/ 46:40 Mobile home parks https://www.wellingscapital.com/ * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

This Flashback Friday is from episode 842 published last Jun 12, 2017. Client and fellow podcaster, Elisabeth Embry joins Jason to discuss the importance of coming to the live events, finding the true value of your properties and what happens when interest rates rise and inventories are low. The upcoming Venture Alliance and Oklahoma City Property Tour and Jason Hartman University Live events are a great way to meet like-minded people who are income property investors. You can share your creative ideas with Jason or any of the investment counselors at these events and there are tried and true professionals who share their real life experience on the panels. Go to JasonHartman.com/Events and sign up today. KEY TAKEAWAYS: 3:26 In a booming real estate market nobody is making money if they don't have any inventory to sell. 7:01 The quality of properties lowers when property inventories are limited. 9:57 Puerto Rico, are the tax breaks worth the risk? 16:30 Zillow could be getting sued for their Zestimates. 23:40 A Trulia article states houses haven't reached the pre-recession peak. 27:40 To see properties that make sense come to the Oklahoma Property Tour and Jason Hartman University Live Event. 30:45 Will there be three rate hikes by the Federal Reserve in 2017? 35:48 Sarbanes-Oxley had very little effect on Wells Fargo thievery. 40:49 If you are a Jason Hartman client and want to contribute to a mutual project or goal contact your investment counselor. MENTIONED IN THIS EPISODE: Renter’s Warehouse - Get 3 free months of property management with this link http://renterswarehouse.com/Jason. Jason Hartman http://www.jasonhartman.com/ Venture Alliance Mastermind http://venturealliancemastermind.com/ Hartman Education https://hartmaneducation.com/ The Jetsetter Show http://jetsettershow.com/ Women Investing Network http://womeninvestingnetwork.com/ * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason makes key announcements regarding Zoom meetings and the importance of regularly checking with investment counselors. He emphasizes the cyclical nature of markets and cautions against complacency, citing Napoleon's quote "The most dangerous moment comes with victory." He then shares insights on a property in Sarasota, Florida, highlighting different proformas based on financing options. Leveraging creative financing, he explores scenarios with varying down payments and discusses post-refinance projections. Hartman invites viewers to join the Empowered Investor cruise and delves into market types and investment strategies. Visit jasonhartman.com for more information. Jason is a guest on the Justin Colby podcast. In a dynamic discussion, Jason emphasizes the urgency of entering the real estate market now. Despite past speculations, timing the market often fails. Jason delves into the historical context, highlighting the scarcity in housing inventory. The low-interest rates during COVID created an asset surge, hindering inventory expansion. With a significant portion of homeowners holding mortgages below 4%, foreclosures are unlikely. Hedge funds are poised to capitalize on any downturn, ensuring market stability. Furthermore, the shortage is exacerbated in entry-level housing, presenting lucrative opportunities for investors. Overall, seizing the moment is crucial amid economic uncertainties. #RealEstateInvesting #HousingMarket #ForeclosureDeals #InvestmentStrategies #PropertyROI KEY TAKEAWAYS: 1:20 Housekeeping: Schedules for our Zoom meetings 2:17 A sobering Napoleon quote 6:45 One property, three proformas 9:25 First proforma- Lowest down, best leverage projection 11:43 Second proforma- 25% down projection 13:57 Join us at the Empowered Investor cruise https://www.jasonhartman.com/ > Supply and demand > Chart: Number of mortgages by interest rates > What the chart didn't show us > Chart: Single family housing units completed For updated numbers this January 2024, visit https://fred.stlouisfed.org/series/ACTLISCOUUS * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason welcomes empowered investors and highlights current market trends. Amidst a frozen market perception, there's still a demand for unique mortgage products, like CrossCountry mortgage's cash offer loan. These products enable buyers to compete with all-cash offers. Jason also cites an article that emphasizes the importance of understanding market statistics, like declining home sizes, which reflect builders' response to affordability concerns. He also clarifies misleading data, such as temporary spikes in foreclosure rates due to calendar-driven anomalies. Additionally, it discusses the societal impact of housing struggles, including reduced intimacy among young adults. #RealEstateTrends #HomeBuyers #HousingMarket #CashOfferLoans #AffordableHousing #ForeclosureData #MarketInsights #PropertyMarket #HomeOwnership #InvestingInRealEstate KEY TAKEAWAYS: 1:57 CountryCross Mortgage unveils cash-offer loan product 7:40 Single-family home size falls to more than a decade low 13:14 We Help Real Estate Investors Close More Deals. Go to https://REsimpli.com/Hartman 14:28 Mortgage delinquency decline reflects 'continued resiliency' of borrowers 19:19 Is the rent killing sex 20:45 Meet the first woman to marry a hologram https://youtu.be/f-bka7iPuNo 22:52 Sign up for the CRUISE and hang out with Jason and other Empowered Investors https://empoweredinvestorlive.com/ 23:35 How to Profit from Millions of Americans Moving to the Suburbs * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

This Flashback Friday is from episode 904 published last November 1, 2017. Over the past few years, investment properties have become harder and harder to get a really good deal, but there are still solid investments available. You just have to be willing to shift your mindset away from what you could have gotten 5, 10, 15 years ago. You're being presented with the ability to have someone put $100+ in your bank account for the next 30 years, for the price of a down payment (around $20,000), not even taking into account all the other tax benefits you'll receive. Jason Hartman and Sara, his investment counselor, talk about what's going on in the investment property market, the importance of a long term plan, and why cash flow can ease concerns of high interest rates. KEY TAKEAWAYS: 4:08 The relative scarcity of real estate is why values continue to go up (and will continue to) 8:02 The marketplace is the marketplace, and we must adjust our expectations in accordance with reality 9:57 How real estate investors who have been doing it for 10+ years are adjusting their expectations for properties "On no other asset class can you get such phenomenal financing, because income property is so secure" 15:25 Investors are having to invest in multiple markets due to low inventory availability 19:53 Jason's upcoming 5 year plan contest 26:33 That interest rates are still this low is baffling to Sara and Jason WEBSITE: Meet the Masters 2018 "People usually underestimate what they can do in 1 year, and they radically underestimate what they can do in 5 years" * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

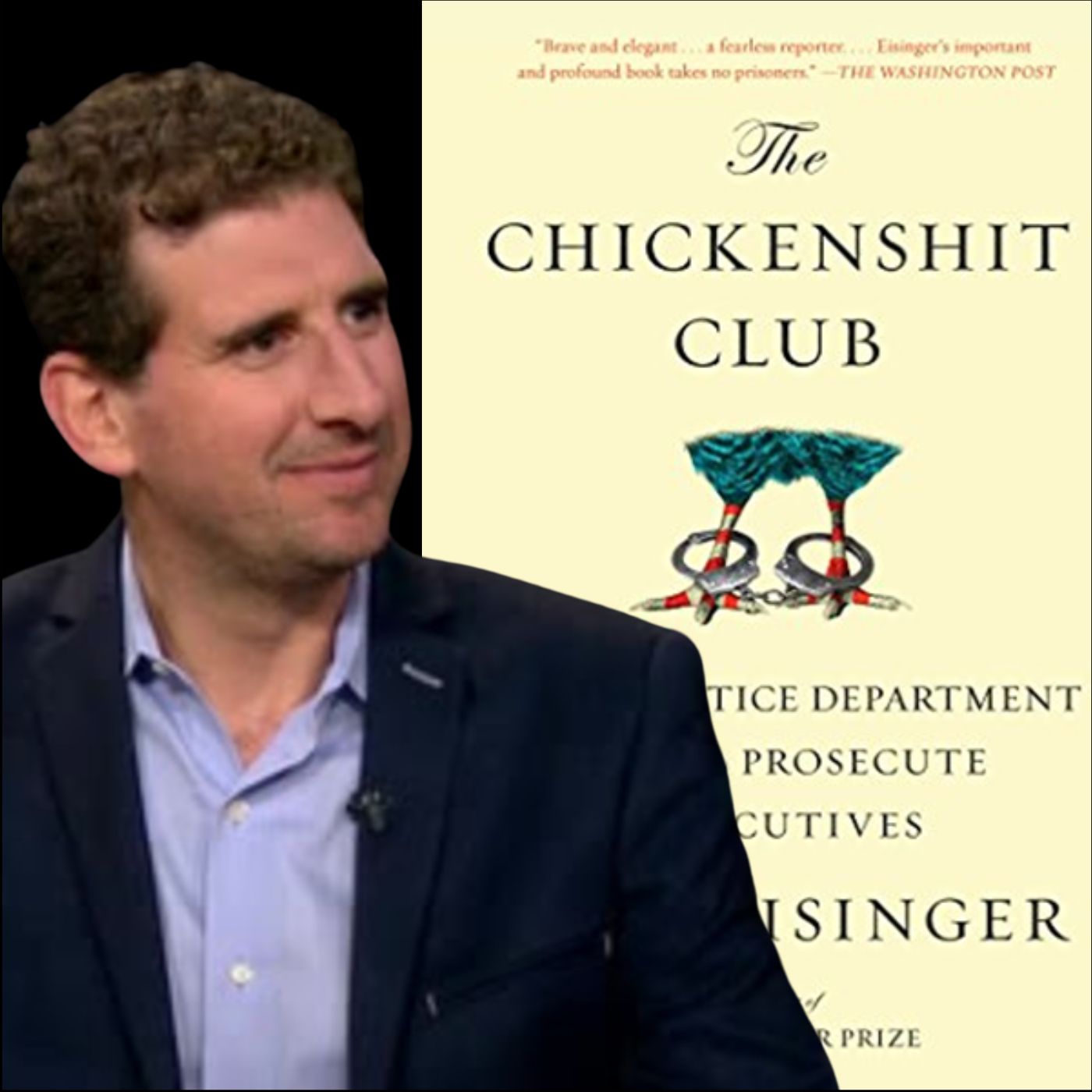

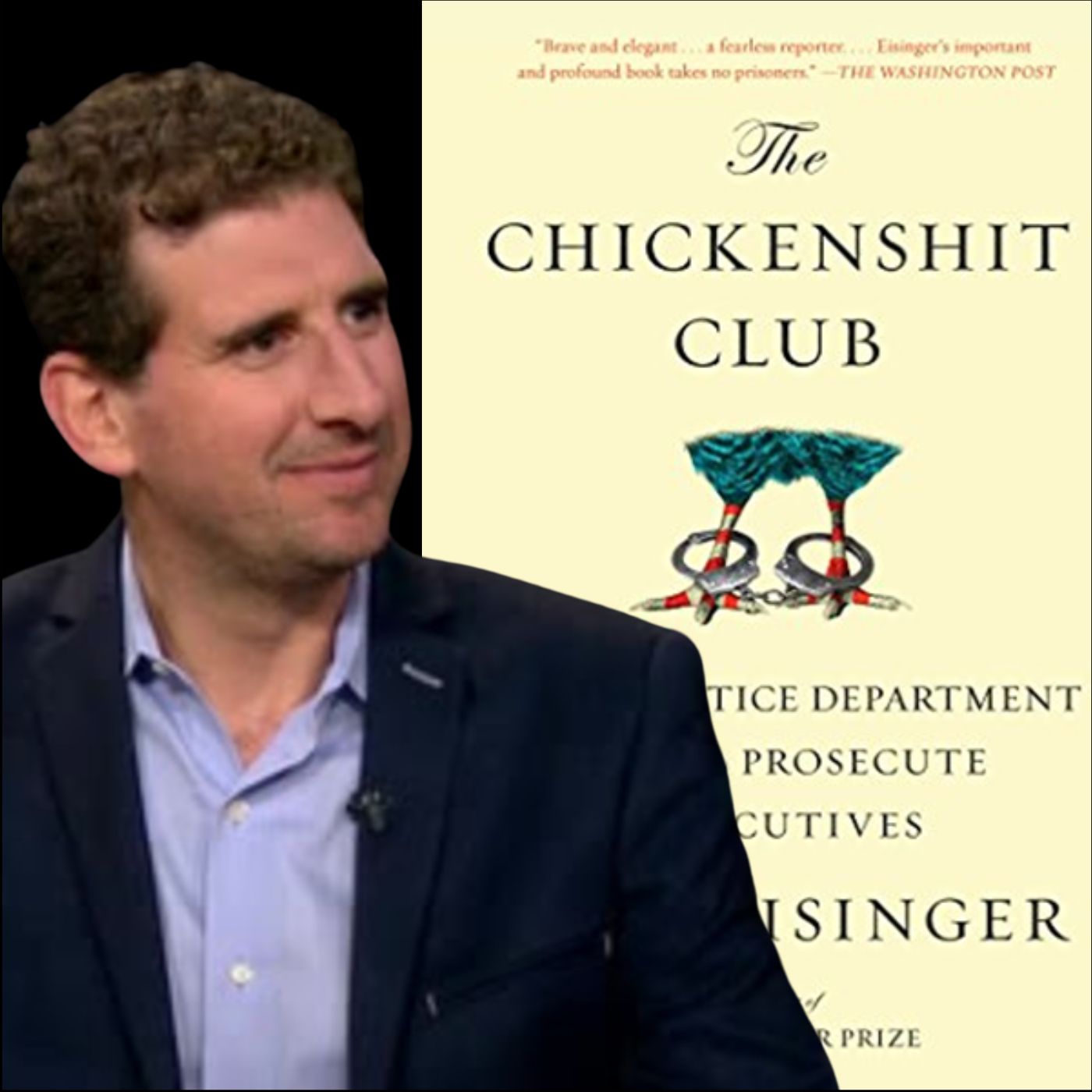

Jason discusses the upcoming episode of their show featuring Jesse Isinger, a Pulitzer Prize-winning reporter, and his work on Wall Street injustices. He also mentioned a report from Redfin and homeownership, noting that the tenure of homeownership has doubled in the past 20 years, and suggested that buying rental property could provide more flexibility for job mobility. Then Jesse Eisinger, Pulitzer Prize-winning reporter from Propublica, joins the show to discuss his investigative work, notably his book "The Chicken Shit Club" focusing on the Justice Department's failure to prosecute corporate executives. Highlighting the lack of accountability in white-collar crime, he explores the roots of elite impunity and the revolving door between government prosecutors and corporate defense. Eisinger emphasizes the need for reform in tax policies, corporate accountability, and lobbying practices, drawing parallels with the progressive era's reforms. He stresses the role of investigative journalism in uncovering abuses of power and promoting democracy amid growing wealth inequality. https://www.ProPublica.org/ #TaxEvasionExposed #CorporateGreedUncovered #JusticeReformNow #WallStreetCorruption #BillionaireScandals KEY TAKEAWAYS: 2:24 Welcome Jesse Eisinger 3:23 Redfin Article: Homeowners are staying in place 12:17 Register for the upcoming cruise today! https://EmpoweredInvestorLive.com/ 12:43 https://www.Baselane.com/Jason 14:10 A lack of prosecution 16:21 A revolving door 18:49 Cost of doing business 23:08 2 components that need reform 27:27 Great reforms in an era of great inequality 30:20 Traitors to our country 33:40 A different kind of ethos 37:33 The advertising culture and consumerism 38:59 Big tech and Antitrust File a complaint at https://www.consumerfinance.gov/ * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason talks about the current state of the real estate market, with emphasis on the high confidence of home builders due to expected future rate cuts and limited inventory of existing homes. The challenges builders face in securing land for construction were also mentioned, despite the market needing more inventory. Additionally, Jason shared updates on an upcoming Zoom meeting about Alabama offerings, the sending out of the first batch of room assignments for a cruise, and his upcoming live talk from a recent event. And check out RESIMPLI. It is the only all-in-one real estate investor CRM software that helps you manage Data, Marketing, Sales and Operations. Sign up to get a 14 day FREE trial today! Plus get 50% OFF on your first month! RESIMPLI- We Help Real Estate Investors Close More Deals. http://jasonhartman.com/simply http://jasonhartman.com/simply and http://jasonhartman.com/simpli http://jasonhartman.com/simpli Jason, speaking at a Family Mastermind conference, delves into the current real estate market amidst rising interest rates, addressing concerns about affordability, particularly among millennials. He emphasizes the importance of context over content, highlighting inflation-induced debt destruction as a strategy for investors. The narrative discusses potential economic collapses, contrasting negative media narratives with the reality of housing market stability. Despite layoffs in tech companies, the net increase in employees remains significant. Additionally, the possibility of mortgage qualification on unemployment insurance is explored. The talk stresses the need to consider long-term market trends and the impact of inflation on debt. #RealEstateMarket #Affordability #Millennials #Inflation #Investing #EconomicCollapse #ContextOverContent #MortgageQualification #UnemploymentInsurance #HousingStability #TechIndustry #MarketTrends #DebtManagement #FinancialStrategy KEY TAKEAWAYS: 1:44 Builder confidence highest since August 3:44 Live Zoom Meeting: Unlocking the secrets of the Alabama Real Estate Investment 4:32 Empowered Investor cruise first batch room assignments 6:07 A few things for Context 8:48 New vs. existing buyers and opportunity costs 16:00 A House of Cards 19:34 The resilience of the Housing market 23:33 Time machine 26:17 Inflation vs. Deflation vs. Tech 28:02 Elephant in the room 30:18 National payment to income ratio * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Today's Flashback Friday is from episode 916, published last Nov 27, 2017. Over the Thanksgiving weekend, Jason Hartman found himself looking through his old books in his mom's house. In the stacks he found two books that were key in his investing journey, The Art of the Deal by Donald Trump, and Mission Success by Og Mandino. Jason explains why these books impacted him so much and why they're still important today. Then, Jason talks with Jeff Meyers, President at Meyers Research, about the state of the housing market across the USA, and how much runway the market might have. They also discuss whether millenials are finally ready to buy their first houses, and the incredible impact the self-driving car will have. KEY TAKEAWAYS: 2:53 The book that turned around Jason's real estate career at the age of 24 6:46 Jason would listen to Og Mandino's Mission Success cassette on repeat 12:20 Walter Hoving's views on capitalism 15:41 Capitalism is the best (and most natural) economic system ever 18:13 A JasonHartman.com sale! $200 off VIP or Elite level Meet the Masters ticket 21:39 Are the millennials finally entering the home buying market? 24:30 There's been a long economic recovery, but housing hasn't led the way so Jeff sees more runway 29:09 When did the real recovery from the Great Recession begin, and how does it affect where we are in the housing cycle? 31:50 Mortgage lending is getting tighter than ever, with the average FICO score on each loan being 720 (the banks are allowed to loan at 680) 33:22 The self driving car could cause a resurgence of the suburbs, but it will DEFINITELY be a game changer for real estate (perhaps like how Amazon has changed the retail industry) 36:035 The cottage industry that could spring up out of the emergence of the self driving car WEBSITE: www.MeyersResearch.com http://www.MeyersResearch.com www.JasonHartman.com/Masters http://www.JasonHartman.com/Masters (promo code "black" for the sale) www.JasonHartman.com/Contest http://www.JasonHartman.com/Contest The Art of the Deal Mission Success by Og Mandino QUOTES: Suburban markets we see some runway. they have not kept up, and that's where a lot of demand is starting to take off. You have to remember that what caused this recession was a direct hit from the mortgage market * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason discusses a survey on the US housing shortage by 11 major firms, emphasizing the severity of the shortage in the entry-level market. He also brought up the rise of romance scams, the importance of reporting them, and urged caution. Lastly, Jason mentioned the increasing trend of STIs. Join the Empowered Investor cruise https://www.jasonhartman.com/ https://www.baselane.com/jason Jason and Mark Moss delve into the media landscape's sensationalism and fear-mongering, particularly in financial spaces. Moss criticizes analysts like Harry Dent, noting their linear thinking and failure to account for the changing dynamics post-2008 crisis. Moss predicts continued government intervention to prop up markets, leading to prolonged debt expansion and diminishing returns. Despite concerns over inflation, Moss argues elites benefit from inflationary policies, making it a preferable choice over deflationary collapse. Moss's insights underscore a nuanced view of economic dynamics and media narratives, emphasizing systemic complexities. #EconomicAnalysis #FinancialInsights #MarketTrends #MacroEconomics #Inflation #DebtCrisis #CentralBanks #GovernmentPolicy #FinancialStrategy #InvestmentOutlook #AssetAllocation #EconomicForecasting #MarketAnalysis #FinancialEducation #RiskManagement #GlobalEconomy #MonetaryPolicy #QuantitativeEasing #MarketManipulation #AssetPrices KEY TAKEAWAYS: 2:07 The housing shortage, as told by 11 major research firms 5:43 Romance scams reported in the US 7:38 Complain to your government 10:20 STI's are on the rise in Europe 11:49 Join the Empowered Investor cruise https://www.jasonhartman.com/ 12:51 https://www.baselane.com/jason 13:44 Is the sky falling? 28:04 The law of diminishing returns 32:08 Crashing down and up 33:39 Maniacal focus on the yield curve 39:31 Nothing moves in a straight line 40:45 Kicking the can down the road by year 2035 43:13 Choose where you want your focus to be 45:16 The first billion dollar solopreneur via Ai * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason shares insights on viewership statistics, comparing historical events like the Moon Landing and Richard Nixon's resignation speech to the Super Bowl, comparing viewership with the world's population growth. He emphasizes the importance of questioning statistics, urging listeners to consider context. He also discusses housing inventory trends, noting a significant decrease from pre-pandemic levels. Jason offers valuable perspectives on media consumption and real estate dynamics. Join the Empowered Investor cruise today. https://www.jasonhartman.com/ Today Jason welcomes YouTube influencer Kevin Paffrath a.k.a. Meet Kevin. In this interview with Kevin, conducted aboard his private jet, he shares insights on the economy, inflation, and investment strategies. Kevin discusses the aftermath of recent global events like the pandemic and geopolitical tensions, foreseeing prolonged economic effects. He emphasizes the importance of the Federal Reserve's intervention to prevent joblessness and advocates for a balanced approach in monetary policy. Kevin recommends focusing on asset acquisition, particularly real estate and stocks, and stresses the value of providing more value to employers and communities. He also suggests exploring professional services as a viable business venture for quick growth. https://www.youtube.com/@MeetKevin KEY TAKEAWAYS: Jason's editorial 1:50 Meet Kevin- in a plane 3:13 Most watched TV programs of all time 6:29 Compared to what? 8:03 Join the Empowered Investor cruise https://www.jasonhartman.com/ 8:37 Chart: Altos single family active inventory 9:50 Kevin's thoughts on the economy and the FED "kicking the can down the road" 12:42 FED: to increase unemployment and print more money 13:51 Ai and the economy 15:07 Deflation and the minority class 18:27 The psychology of the Stock market 22:48 Crypto, insurance products and commodities 25:34 NAR lawsuit and it's effect on consumers 28:02 Providing value * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

This Flashback Friday is from episode 892, published last Oct 4, 2017. Jason welcomes client, Clay Slocum to the show. Clay is a millennial who currently has four properties in his real estate portfolio. Before buying his first property, Clay worked diligently with his Investment Counselor, and a Local Market Specialist to play around with the numbers and he discovered his initial investment could grow exponentially. Clay shares his insights on the power of compounding interest, asset protection, and the Memphis market. KEY TAKEAWAYS: 01:23 Jason comments on the Las Vegas terrorist attack. 09:56 Compound interest can be a powerful tool against inflation. 15:38 Engineers take an analytical approach to investing. 17:48 After 18 years, $100,000 grow to 14 million. 25:09 Jason explains a Deferred Sales Trust. 29:05 If you are on the fence about investing talk with an investment counselor. 39:59 Asset Protection is a complicated subject you should speak with a lawyer about. 49:24 Resources for tax help. MENTIONED IN THIS EPISODE: Jason Hartman http://www.jasonhartman.com/ Meet the Masters of Income Property Event Real Estate Tools - Property Tracker Software http://realestatetools.com/ Venture Alliance Mastermind http://venturealliancemastermind.com/ Compound Interest Calculator * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

From Dallas, Texas, Jason discusses mortgage equity growth, emphasizing responsible lending and increased homeowner equity. He notes a significant rise in home values and stable mortgage underwriting standards post-Great Recession. Analyzing credit score trends, he highlights a decline in low-score mortgage originations, indicating a healthier market. Additionally, he attributes job growth to demographic shifts, foreseeing a prolonged labor shortage and sustained wage increases. Lastly, he promotes an upcoming investor cruise. Hartman's insights provide valuable perspectives on the real estate market and economic trends, fostering informed investment decisions. https://www.jasonhartman.com/ Then Jason and Curtis Moe discuss Curt's journey to wealth through real estate. Curt shares his experiences with self-management, property maintenance, and insurance claims. They also talked about the importance of discipline and strategic investment in real estate, emphasizing the idea of building wealth through base hits rather than home runs. Jason and Curt also highlight the power of momentum and consistency in business and life. #RealEstateInvesting #PropertyManagement #FinancialMaturity #Persistence #SelfManagement #InsuranceClaims #Mindset #PersonalDevelopment #WealthBuilding #Resourcefulness #JasonHartmanShow KEY TAKEAWAYS: 1:44 Jason in a large Dallas hotel room 2:37 Mortgage holders gained $1.6 trillion in equity in 2023 4:50 Low credit scores originations 8:06 The US economy in 2024 10:24 Register for our Empowered Investor Cruise. Early bird rates ends TODAY. https://www.jasonhartman.com/ 10:54 Curtis' first property and insurance claims 14:41 Self-management and the support of Empowered Investor Pro 16:58 Downsizing life and exhibiting financial maturity 19:00 Graduating from the "Dave Ramsey" school 20:34 Rewarding yourself a little bit along the way 22:12 Income property- having security after getting laid off 23:51 The Property Tracker & Evaluator app 25:33 Momentum and building wealth one house at a time 30:17 Mentors and influences to Curt's mindset * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason Hartman introduces his new Apple Vision Pro goggles and discusses their incredible technology. He highlights the intuitive software, virtual keyboard, and compares it to the futuristic computing seen in the movie Minority Report. While expressing amazement at the technology, Hartman mentions the heavy weight of the goggles and his preference to wait for version 2. He then shifts to discussing the optimistic Fannie Mae prediction of mortgage rates dipping below 6%, foreseeing a significant increase in home sales and improved affordability. He also invites you to join the Empowered Investor Cruise and talks about the benefits of joining as a pro member. Go to https://www.jasonhartman.com/ today! Jason then welcomes Brian Domitrovic. Brian is associated with the Laffer organization, discusses the influential Laffer curve and its role in the Reagan revolution and supply-side economics. The Laffer curve illustrates the correlation between tax rates and revenues. Brian emphasizes its historical significance, touching on its introduction during the Gerald Ford presidency. The conversation explores the tax history of the United States, its implications during the Great Depression, and the transformative impact of tax rate cuts on economic growth and job creation. He also delves into the intricate relationship between tax policies and real estate investments. For more insights, visit https://laffercenter.org/ and https://www.globalmonetarism.com/ KEY TAKEAWAYS: 1:30 Jason showing his "Apple Vision Pro" goggles 5:31 Fannie Mae optimistic and 30-year Fixed Rate Mortgage forecast 6:13 Chart: Existing home sales 7:19 Chart: Buying power and sensitivity 8:43 Chart: Total inventory for sale 10:12 Join the Empowered Investor Cruise https://www.jasonhartman.com/ Brian 12:13 The mythology of the Laffer curve 14:27 A radical idea at the time 15:48 The reality of marginal tax rates vs. actual tax 18:22 Supply side and trickle down economics and thermo-dynamic rush 21:07 Big company offshoring profits and not giving back to the American economy 23:45 Property taxes and the Great Depression 26:29 Book: Taxes Have Consequences, The FED and the tax code 30:37 The real estate tax code 32:27 Tax sheltering for the top 1% earners in the US 34:56 JFK, LBJ and Reagan 37:53 Government, get out of the way! * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

This Flashback Friday is from episode 904, published last November 1, 2017. Over the past few years, investment properties have become harder and harder to get a really good deal, but there are still solid investments available. You just have to be willing to shift your mindset away from what you could have gotten 5, 10, 15 years ago. You're being presented with the ability to have someone put $100+ in your bank account for the next 30 years, for the price of a down payment (around $20,000), not even taking into account all the other tax benefits you'll receive. Jason Hartman and Sara, his investment counselor, talk about what's going on in the investment property market, the importance of a long term plan, and why cash flow can ease concerns of high interest rates. KEY TAKEAWAYS: 4:08 The relative scarcity of real estate is why values continue to go up (and will continue to) 8:02 The marketplace is the marketplace, and we must adjust our expectations in accordance with reality 9:57 How real estate investors who have been doing it for 10+ years are adjusting their expectations for properties 15:25 Investors are having to invest in multiple markets due to low inventory availability 19:53 Jason's upcoming 5 year plan contest 26:33 That interest rates are still this low is baffling to Sara and Jason WEBSITE: Meet the Masters 2018 "People usually underestimate what they can do in 1 year, and they radically underestimate what they can do in 5 years" "On no other asset class can you get such phenomenal financing, because income property is so secure" * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Jason welcomes returning guest Martin Armstrong, an undiscovered economist known for his brilliance. He also discusses last year's unexpected real estate appreciation, debunking crash predictions. Jason emphasizes the multi-dimensional benefits of income property, contrasting it with misleading comparisons to stock market returns. Leveraging a $350,000 house with 6.6% appreciation, he illustrates a 33% return on investment with just a 20% down payment. He also promotes the upcoming Empowered Investor Cruise and Baselane, a banking platform for real estate investors. Overall, it explores economic insights and practical investment strategies. https://empoweredinvestorlive.com/ Jason welcomes back guest Martin Armstrong, a renowned economic forecaster. The conversation touches on Armstrong's background, experiences in the financial industry, and his computer-driven approach to analysis. Armstrong's economic confidence model predicts a peak on May 7th, signaling a shift towards a recession, civil unrest, and international conflicts into 2028. He emphasizes the significant role of the U.S. as a consumer-based economy and the global demand for American products, asserting that despite challenges, the U.S. dollar remains a strong reserve currency. Armstrong also discusses economic dynamics in Europe, Japan, and China. KEY TAKEAWAYS: 1:30 We've got Martin Armstrong today 2:16 Early bird rates expires soon! Join the Empowered Investors cruise 3:17 Chart: Case-Shiller: National House Price Index Up 7:15 Quickie Napkin Math 11:29 https://www.Baselane.com/Jason 12:27 A historic overview by Martin Armstrong and the currencies 17:31 Data driven approach 21:11 Economic Confidence Model 22:02 May 7, 2024: save the date 25:22 The past 10 years and what it means to us now 30:49 The future is... stagflation and Inflation 35:33 CBDCs and big tech https://www.armstrongeconomics.com/ * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

Today's 10th episode guest is Stephen M.R. Covey, son of the late Dr. Stephen Covey, known for "The 7 Habits of Highly Effective People." They discuss Covey's book "The Speed of Trust," emphasizing the importance of trust in leadership. Jason also criticizes sensationalized predictions by financial gurus and questions why people don't sue them for missed opportunities. He promotes taking action and avoiding a spectator mentality in investing. The episode also previews the upcoming Empowered Investor Cruise with guest speakers Robert Helms, Scot Porier and more. https://empoweredinvestorlive.com/ Jason welcomes Stephen M.R. Covey as they discuss his book "The Speed of Trust." In business, cultivating trust is key for successful deals and relationships. The principle of "win-win or no deal" emphasizes fair collaboration, where both parties benefit. Trust fosters enduring relationships, enabling faster, more efficient cooperation. Smart trust involves assessing situations, clarifying expectations, and ensuring accountability. While contracts are necessary, they can't substitute genuine trust. Transparent, open, and fair dealings build reputations that lead to repeat and referral business. Long-term success lies in creating a high-trust culture, where mutual respect and consideration drive not just transactions, but positive, enduring partnerships. KEY TAKEAWAYS: 2:15 We welcome Stephen M.R. Covey to our 10th show 3:16 Why do people trust these people 8:37 Join the Empowered Investors cruise https://empoweredinvestorlive.com/ 11:17 Welcome, Stephen 12:26 What is trust? 13:51 A tall order- developing trust 16:56 Smart trusting- giving trust without being a 'doormat' 20:00 Trust- AND verify 22:03 Trust in Fortune 1,000 companies 24:39 High trust dividends 29:37 My cynical views and a perpetual downward cycle 34:35 Solutions in building trust * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

This Flashback Friday is from episode 854 published last July 10, 2017. In between activities during the Oklahoma City JHU Live event is a great time to record a podcast with new income property investors. David & Gina Nelson share their story of the life-changing decisions that led to investing in real estate with Jason. David & Gina recognized staying in their corporate positions and only investing in the stock market wouldn’t get them where they wanted to be in life. They convey their appreciation for the transparency and support they have received from the Jason Hartman Investment Counselors and share their advice on how you too can have the diversified financial future you deserve. KEY TAKEAWAYS: 01:53 David & Gina wanted to take control of their lives and build their wealth by investing in income properties. 06:28 You are never too old or too young to start investing in your future and real estate. 09:46 The portfolio builder game is a great way to find out what type of investor you are. 12:29 The Nelson's plan to retire next year and use income property as their wealth vehicle. 17:25 The value in understanding the linear, hybrid and cyclical markets. 21:09 David & Gina recommend finding a mentor and listening to podcasts to educate yourself. MENTIONED IN THIS EPISODE: Jason Hartman http://www.jasonhartman.com/ Venture Alliance Mastermind http://venturealliancemastermind.com/ * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/

In this episode, Jason features Robert Helms of the Real Estate Guys. He also discussed "generational investing" i.e. the possibility of children investing in real estate and the importance of not trying to time the market. Jason then moves on to discuss the impact of declining interest rates on the housing market, projecting that a drop to 5.5% could allow an additional 7.7 million people to afford a home loan. He highlights the benefits of owning a home and promoted Baselane, a banking platform designed for landlords. Then Jason welcomes Robert Helms as they discuss the real estate market's dynamics, including their merged mastermind groups forming The Collective Inner Circle. They delve into the current state of the market, highlighting constrained inventory and varying opinions on interest rates. Helms suggests a potential softening but cautions against waiting for ultra-low rates. The conversation explores the challenges of market timing and emphasizes understanding the asset's long-term value. Jason predicts a lingering housing shortage, emphasizing the lock-in effect with existing mortgage rates below new rates. They discuss frozen market effects, economic stimulus, and the potential impact on real estate dynamics. KEY TAKEAWAYS: 1:29 Join the Empowered Investors cruise https://empoweredinvestorlive.com/ 2:26 Chart: Fannie Mae's revised mortgage rate predictions 6:43 Chart: Buying power & sensitivity 8:13 Chart: Total inventory for sale as of Dec 2023 10:13 Check out https://www.baselane.com/jason 12:49 Welcome! Robert 13:38 Where is the market going 15:56 Timing the market and it's shortage 20:48 Housing affordability and the lock-in effect 24:57 The Fed, the Frozen effect and deflation 28:01 Charts: Interest rates, Buying power and housing supply 33:53 The psychology of money 35:39 Generational investing Join the Empowered Investors cruise https://empoweredinvestorlive.com/ * Follow Jason on TWITTER, INSTAGRAM & LINKEDIN Twitter.com/JasonHartmanROI Instagram.com/jasonhartman1/ Linkedin.com/in/jasonhartmaninvestor/ Call our Investment Counselors at: 1-800-HARTMAN (US) or visit: https://www.jasonhartman.com/ Free Class: Easily get up to $250,000 in funding for real estate, business or anything else: http://JasonHartman.com/Fund CYA Protect Your Assets, Save Taxes & Estate Planning: http://JasonHartman.com/Protect http://jasonhartman.com/Protect Get wholesale real estate deals for investment or build a great business – Free Course: https://www.jasonhartman.com/deals Special Offer from Ron LeGrand: https://JasonHartman.com/Ron https://jasonhartman.com/Ron Free Mini-Book on Pandemic Investing: https://www.PandemicInvesting.com https://www.pandemicinvesting.com/