854 episodes

https://tix.to/pm-book-tour ICE is scaling up, with rapid new hiring. So we ask, has training new officers changed? At what cost? Also, the Trump administration has plans to pour billions of dollars into warehouses for mass immigrant detention centers, which can totally change the economy of some areas. We hear from a rural town in Georgia that wants an ICE facility in its own backyard. These episodes were originally published on Planet Money’s sister daily podcast The Indicator. https://www.planetmoneybook.com/ https://n.pr/3HlREPz Listen free: http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W Listen to the https://open.spotify.com/show/4X3yDKgVTWRjSd6r0vhgo4?si=IaygGVB_QYurvweN-1zK-w&nd=1&dlsi=e440f1ac7f3f4d43 https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq/ Our weekly https://n.pr/3zrFvUB The Indicator Planet Money Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Live event info and tickets here. https://tix.to/pm-book-tour The Supreme Court has spoken. Those big, sweeping tariffs that President Trump imposed early last year? They’re illegal. On today’s show: Why were those tariffs struck down? Will anyone get refunds? And …what about this new 10 percent tariff the President just announced today? Plus — a growing market for tariff refunds. Further Listening: - Worst. Tariffs. Ever. https://www.npr.org/2024/12/11/1218506684/worst-tariffs-ever-update - Tariffs: What are they good for? https://www.npr.org/2025/04/02/1242229719/planet-money-the-case-for-tariffs - What "Made in China" actually means https://www.npr.org/2025/05/07/1249592921/tariff-customs-made-in-america-china-france - The 145% tariff already did its damage https://www.npr.org/2025/05/16/1251782092/tariff-us-china-pause-trade-war - Are Trump's tariffs legal? https://www.npr.org/2025/06/11/1253992700/tariffs-ieepa-trump-legal-emergencies-law - Days of our Tariffs https://www.npr.org/2025/11/19/nx-s1-5608384/tariffs-consumers-shipping-shopping-prices - Trump's backup options for tariffs https://www.npr.org/2025/11/12/nx-s1-5605545/trumps-backup-options-for-tariffs - What would it mean to actually refund the tariffs? https://www.npr.org/2025/12/02/nx-s1-5627159/what-would-it-mean-to-actually-refund-the-tariffs https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Planet Money Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

https://tix.to/pm-book-tour Greenland has said it is not for sale. Denmark has said it can’t even legally sell Greenland. And at a security conference in Munich over the weekend, U.S. lawmakers spent a lot of time trying to walk back some of President Trump’s recent threats to try to buy, or even take over, the territory. But whether Trump can or will or should try to control or purchase a territory that doesn’t want to be sold is not the interesting question. What is interesting is how we got to this moment. And, how we might gracefully get out of it. Greenland is valuable for its minerals and because of its physical location in the world. (It’s easy to keep an eye on other countries from Greenland). Our latest: How the U.S. dropped the ball on the rare earths race. And one way the U.S. gets strategic locations without threatening to buy or take over an entire territory. https://www.npr.org/2026/01/21/nx-s1-5683139/is-greenland-really-an-untapped-land-of-riches https://www.npr.org/2025/01/21/1225890655/add-to-cart-greenland https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Book tour event details and ticket info here https://tix.to/pm-book-tour. An iconic cartoon character liberated from copyright, journalism from the world of competitive spreadsheeting, a controversial piece of US currency. Each year the Planet Money team dedicates an episode to the things we simply love and think you, our audience, will also love. In this year’s Valentine’s Day episode: __ __ Download THE OFFICIAL Planet Money valentine here https://www.dropbox.com/scl/fi/w5jcio1w98okftefdxk3z/Official-Planet-Money-Valentine-2026.pdf?rlkey=8vbbras56o6jigkvmftfvia1b&st=jte9em3s&dl=0. https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Book tour tickets and details here https://tix.to/pm-book-tour. Today, the story of three inventions. The first, the sewing machine, was created by a selfish and ambitious inventor who wanted all the credit and was willing to fight a war for it. The second, a more modern invention, was made by an Italian inventor who wanted only to connect the world through video, so “evvvvverybody can talk with evvvvverybody else.” And, a third invention that tied them both together across more than a century. The patent pool. How do people get motivated to invent, and how do they get rewarded for their ideas? Usually through a patent. And, when the thicket of patents become too thick, how do we simplify, and make it so inventors can work together? The answer will involve bitter rivals, a sewing machine war, the nine no-no’s of anti-trust, and something called a gob-feeder. https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Planet Money's Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Book tour tickets and details here https://tix.to/pm-book-tour.The recent protests in Iran are about so many things. Human rights, corruption, freedom. But this time – they are also motivated by economic hardship. Hardship caused, in part, by US sanctions. The US has been sanctioning Iran in one way or another for 47 years. But sanctions, as a tool, only work some of the time, and US sanctions on Iran have not always conformed to what experts consider best practices.On today’s episode: What did US sanctions do to Iran's economy? How did they feed into the latest protests and crackdown in Iran? Sanctions are supposed to avert war, but how different from war are they? https://n.pr/3HlREPz Planet Money Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Planet Money book tour ticket info and dates here https://www.planetmoneybook.com/. A record number of Americans with poor or just okay credit are behind on their car payments. And once last year’s numbers are tallied, an estimated 3 million cars will have been repossessed in 2025. That would be on par with how bad it got during the Great Recession. What’s going on? And why now? Today on the show, we focus on the micro part of the story to answer the macro question. First, we hear a favorite story of ours from 2019. We follow the lifecycle of a delinquent car loan from three different perspectives: the salesman, the driver, and the repo man. Then we’ll hear an update from them in 2026 as we try to find out why so many Americans are behind on their car payments. https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Planet Money Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

https://www.planetmoneybook.com/ Housing is too expensive. Everyone knows this. Democrats know that talking about it plays well with voters. And now – in a midterm election year – President Donald Trump seems to be focused on it, too. His administration has recently started talking more about affordability. And they’re taking action with two new initiatives that aim to make buying a house easier. Today on the show, we’re gonna take a close look at these two moves. And ask: Will they work? https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

In the 1990s, Congress created HOPE VI, a program that demolished old public housing projects and replaced them with more up-to-date ones. But the program went further than just improving public housing buildings. HOPE VI was designed to transform neighborhoods with concentrated poverty into neighborhoods that attracted people with different incomes. Some people who moved to HOPE VI neighborhoods earned too much to qualify for public housing. And some even paid for market-rate housing. The idea was that this would help create new opportunities for the low-income people who lived there and even lift people out of poverty. For years though, there wasn’t a clear answer to whether this approach actually succeeded. A new working paper https://opportunityinsights.org/wp-content/uploads/2025/09/HopeVI_Paper.pdf from Raj Chetty and the team at Opportunity Insights finally provides some answers. On today’s show: Who really benefits when people living in poverty are more connected to their surrounding communities? Are there lessons from the HOPE VI experiment that could apply to other kinds of policies aimed at fostering upward mobility? http://npr.org/2026/01/28/nx-s1-5691692/hope-vi-public-housing-opportunity-insights-raj-chetty https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Book tour dates and ticket info here https://www.planetmoneybook.com/. Just as every market has its first movers, every religion has its martyrs — the people willing to risk everything for what they believe. Pastor Dave Hodges just might be a little bit of both. He’s the spiritual leader of the Zide Door Church of Entheogenic Plants, in Oakland, California which places psilocybin mushrooms at the center of their religious practice. Today on the show, like its 130,000+ members, we’re going to take a trip through the psychedelic mushroom megachurch. We’ll meet one of the lawyers trying to keep psychedelic religious leaders like Pastor Dave from running afoul of the law, and get a peek into how the government decides whether a belief system counts as sincere religion. https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Planet Money Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Planet Money has teamed up with the company Exploding Kittens to make a board game inspired by the legendary economics paper The Market for Lemons. We’ve decided we want a mass-appeal party game that quietly sneaks in the economics, so that we can report from inside a world that no other Planet Money project has entered: the real shelves at real big box retail stores. We have a great game mechanic and a set of rules. Now all we need is a good name and theme. Turns out, that is way harder and way higher stakes than any of us could have imagined. In the third episode of our series, we learn the importance of a good game name and theme and try to come up with one for our game. Find our previous episodes in the board game series https://www.npr.org/series/g-s1-89455/planet-money-makes-a-boardgame, here https://www.npr.org/2025/10/01/nx-s1-5558425/planet-money-board-game-episode-1 and here https://www.npr.org/2025/10/03/nx-s1-5561924/planet-money-board-game-episode-2. https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Venezuela and Chevron have perhaps one of the strangest partnerships … ever? Chevron, one of the world’s most famous and profitable oil corporations, has for decades, been plugging away in Venezuela, one the world’s most famous and infamous socialist countries. Today on the show, the story of their intertwined histories. Before Saudi Arabia, before Iran… there was Venezuela, the first petrostate. The first country whose entire economy became dependent on oil. With the blessing of oil, an entire economic textbook of complications opened up: from the Dutch Disease, to the resource curse, to mono-economic vulnerability. And, oddly, along for that ride…Chevron. https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Planet Money Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

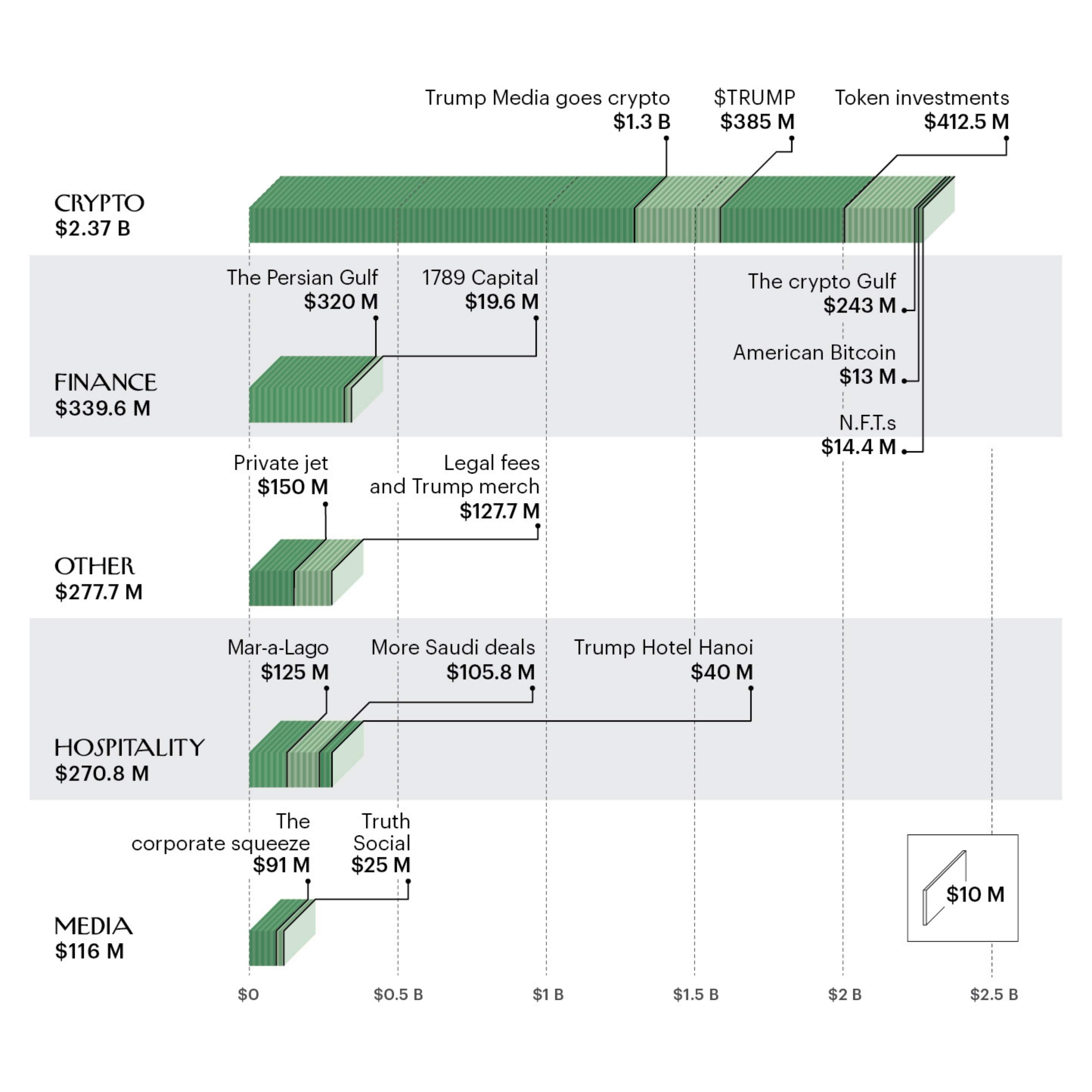

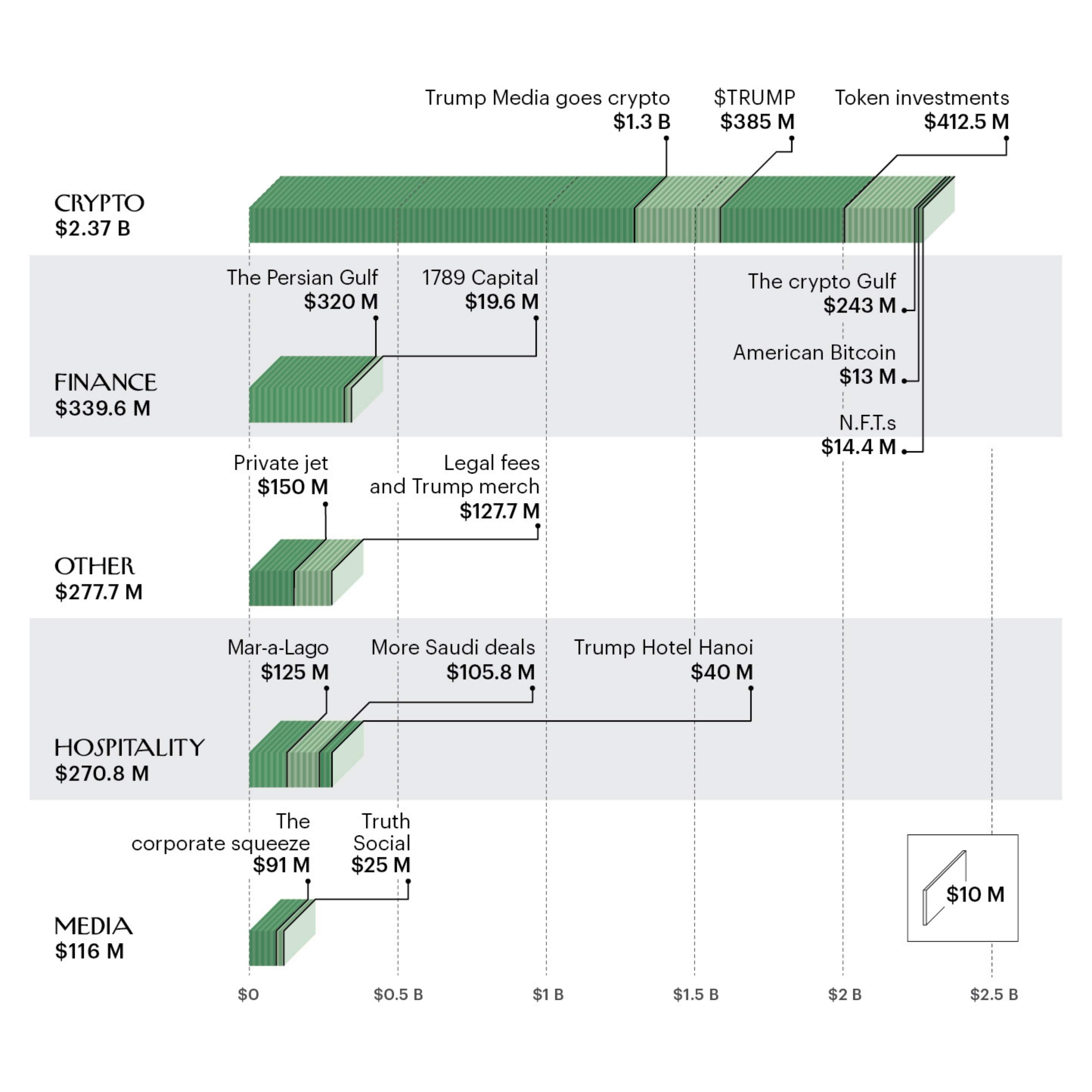

Before President Donald Trump’s first term, he was in a “tight spot” financially, according to New Yorker writer David Kirkpatrick. At the start of his second term, David says, Trump was in an “even tighter” spot. But after just six months into his second term, Trump’s financial situation started looking really good. David has done a full accounting for what the family has been up to, and even using conservative estimates, David says Trump and his family have made almost $4 billion dollars “off of the presidency,” in just about a year https://www.newyorker.com/magazine/2025/08/18/the-number. Today on the show: we look at every new business and business deal and financial transaction that David says likely would not have happened if Trump wasn’t the president of the United States. And we stop at the most innovative ways Trump and his family have made all that. https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://open.spotify.com/playlist/41P3yZxB3shWf1z910cmg6?si=pYydN-8NRlScwfxG9bfCtQ&nd=1&dlsi=1fba28358cab4b77 https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Are we in an AI bubble? That’s the $35 trillion dollar question right now as the stock market soars higher and higher. The problem is that bubbles are famously hard to spot. But some economists say they may have found some telltale clues. On our latest: How do economists detect a bubble? And, how much should society be worried about bubbles in the first place? https://www.npr.org/2025/12/11/nx-s1-5639951/how-to-make-35-trillion-disappear https://www.npr.org/2021/06/30/1011906325/whats-a-bubble-classic https://www.npr.org/2025/12/19/nx-s1-5649814/ai-data-center-electricity-bill https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

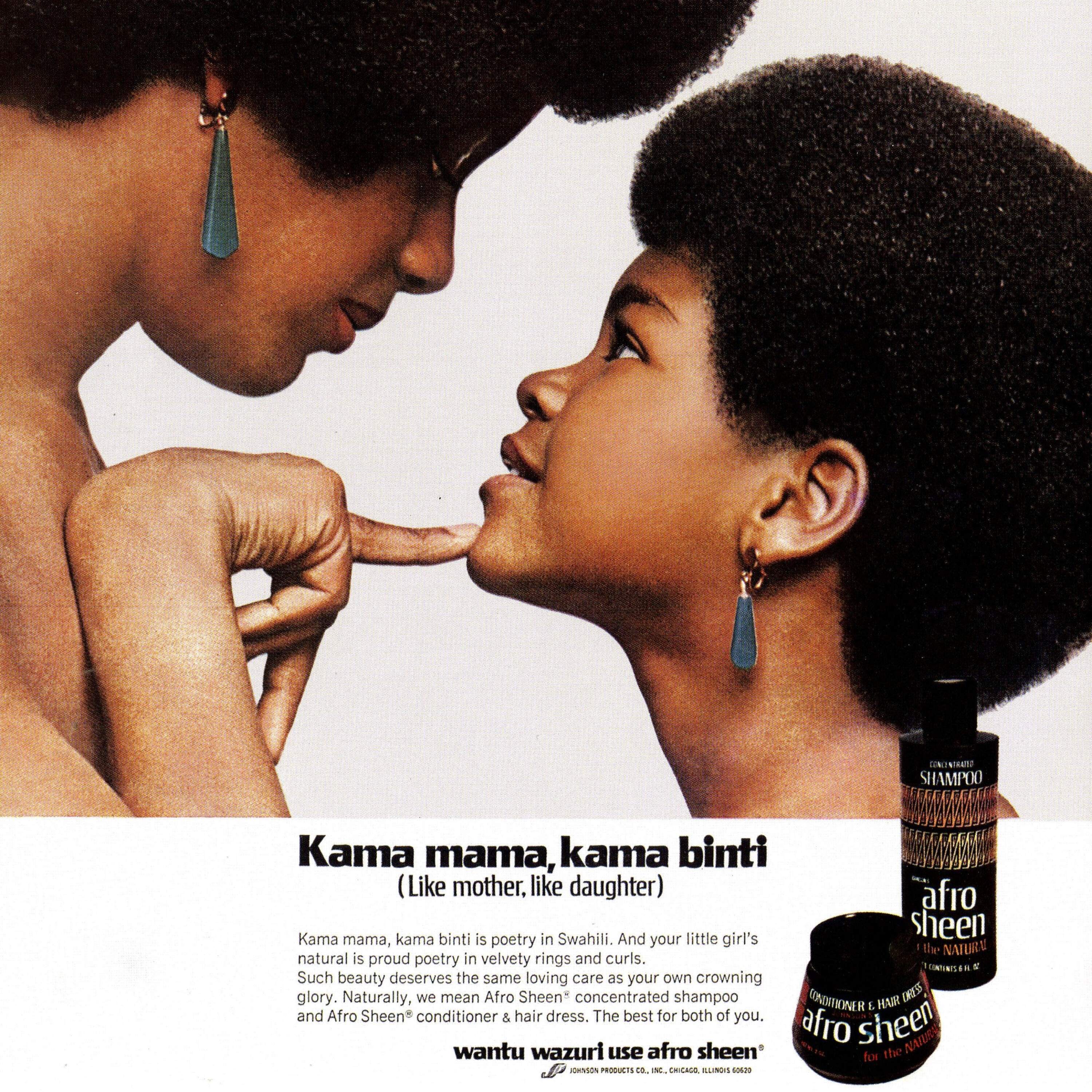

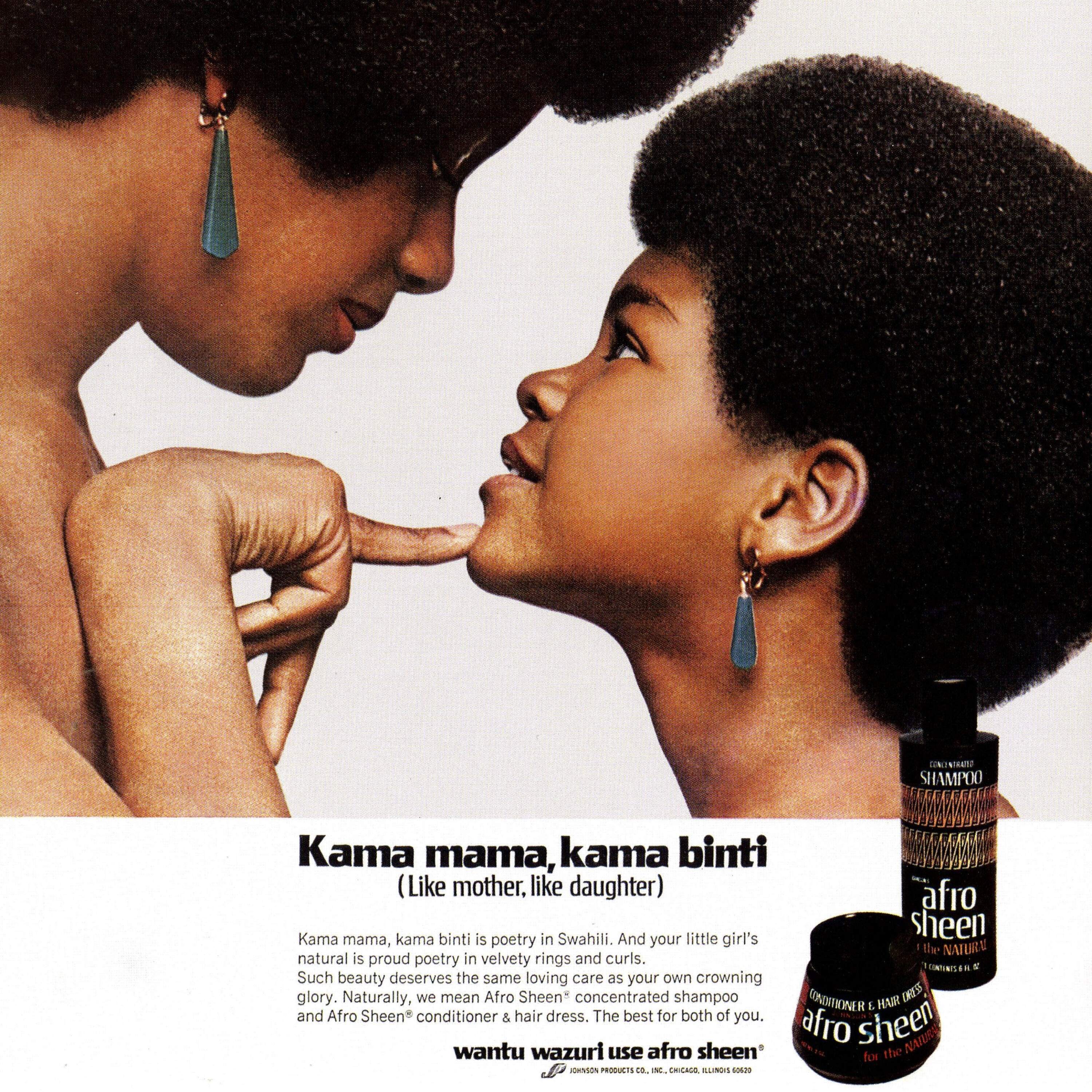

The Afro is one of the most iconic hairstyles of the last century. And one of its main ingredients was a hair product – Afro Sheen. But Afro Sheen did so much more than make Black afros shine. It was the money behind the television show Soul Train, it helped fuel the civil rights movement – all because of an entrepreneur named George Johnson. For decades, Joan and George Johnson owned and ran Johnson Products Company, a Black hair care company out of Chicago. Their intimate understanding of what Black people wanted and needed – for their hair and for their lives – helped grow the Black middle class and became an engine for Black culture and power. They helped turn the Black haircare industry into what is now a multi-billion-dollar industry. But although they helped create this industry, they no longer have a part in it. Today on the show – the story of the rise and fall of Johnson Products. We’re gonna tell you this story in three hairstyles. The conk, the afro… and the jheri curl. RELATED EPISODES: This Ad’s For You https://www.npr.org/sections/money/2017/09/06/548923095/episode-628-this-ad-s-for-you 'Soul Train' and the business of Black joy https://www.npr.org/2022/01/21/1074784689/soul-train-and-the-business-of-black-joy Fashion Fair's makeover https://www.npr.org/2022/03/25/1088853393/fashion-fairs-makeover https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

We’ve been checking in on the economic conditions in Venezuela for about a decade now. In response to the U.S. strike and the capture of Venezuelan president Nicolás Maduro this weekend, we’re re-surfacing this episode with an update. The original version ran in 2016 https://www.npr.org/sections/money/2016/10/21/498867764/episode-731-how-venezuela-imploded, with an update in 2024 https://www.npr.org/2024/10/02/1202966830/venezuela-hyperinflation-maduro-gonzalez. Back in 2016, things were pretty bad in Venezuela. Grocery stores didn’t have enough food. Hospitals didn’t have basic supplies, like gauze. Child mortality was spiking. Businesses were shuttering. It was one of the epic economic collapses of our time. And it was totally avoidable. Venezuela used to be a relatively rich country. It has just about all the economic advantages a country could ask for: Beautiful beaches and mountains ready for tourism, fertile land good for farming, an educated population, and oil, lots and lots of oil. But during the boom years, the Venezuelan government made some choices that add up to an economic time bomb. Today on the show, we run through the decisions that foreshadowed the collapse, and we hear from people in Venezuela in 2016 at a particularly low point for the economy, then again and in 2024 after a bounce back and a stabilization, in part due to the unlikely impact of the U.S. dollar. https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB http://plus.npr.org/ http://plus.npr.org Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

2025 is finally over. It was a wild year for the U.S. economy. Tariffs transformed global trading, consumer sentiment hit near-historic lows, and stocks hit dramatic new heights! So … which of these economic stories defined the year? We will square off in a family feud to make our case, debate, and decide it. Also, as we enter 2026, we are watching the trends and planning out what next years stories are likely to be. So we’re picking which indicators will become next years most telling. On today’s episode, our indicators of this past year AND our top indicator predictions for 2026. RELATED EPISODES: The Indicators of this year and next https://www.npr.org/2024/12/25/1221512103/indicator-of-the-year-family-feud (2024) This indicator hasn’t flashed this red since the dot-com bubble https://www.npr.org/2025/11/06/nx-s1-5600041/this-indicator-hasnt-flashed-this-red-since-the-dot-com-bubble What would it mean to actually refund the tariffs? https://www.npr.org/2025/12/02/nx-s1-5627159/what-would-it-mean-to-actually-refund-the-tariffs What AI data centers are doing to your electric bill https://www.npr.org/2025/12/19/nx-s1-5649814/ai-data-center-electricity-bill What indicators will 2025 bring? https://www.npr.org/2024/12/23/1221439465/indicators-of-the-year-economy-tariffs-inflation-soft-landing https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB http://plus.npr.org/ http://plus.npr.org Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

As U.S. trade with China exploded in the early 2000's, American manufacturing began to shrivel. Those workers struggled to adapt and find new jobs. It ran counter to how mainstream economics at the time viewed free trade ... that it would be a clear win for the U.S. Greg Rosalsky talks with David Autor about why economists got free trade with China so wrong. Autor, an MIT economics professor, and his colleagues published a series of eye-opening studies over the last 15 years or so that brought to light the costs of U.S. trade with China. We also hear Autor's thoughts on the role of tariffs and get an update on his research. With better, more precise data, Autor says we have a more nuanced and "bleaker" picture of what happened to these manufacturing workers. You can read about Autor's research and sign up for The Planet Money Newsletter here https://www.npr.org/2025/02/11/g-s1-47352/why-economists-got-free-trade-with-china-so-wrong. To hear more bonus content like this and support NPR and public media, sign up for Planet Money+ in Apple Podcasts or at plus.npr.org/planetmoney http://plus.npr.org/planetmoney. Regular episodes remain free to listen! Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Most stories keep going even after we set down our microphones and the music fades up. That's why, at the end of each year, we look back and we take stock. We call this tradition "The Rest of the Story." And we bring you updates on the stories we've reported, and from the people we've met along the way. Today, we check in on an engineer and patent attorney who made a safer saw; we get an update on the Planet Money game; an update on money in Gaza; and we have updates on a diamond that may or may not have had a second life. Listen to the original stories: The Subscription Trap https://www.npr.org/2024/10/18/1210938543/subscription-economy-dark-patterns-negative-option-billing-click-to-cance Planet Money buys a mystery diamond https://www.npr.org/2025/03/26/1240892101/diamond-market-natural-lab-grown-gemological In Gaza, money is falling apart https://www.npr.org/2025/09/20/nx-s1-5547307/gaza-palestine-israel-shekel-cash-shortage BOARD GAMES 1: We're making a game https://www.npr.org/2025/10/01/nx-s1-5558425/planet-money-board-game-episode-1 How to save 10,000 fingers https://www.npr.org/2024/09/20/1200551215/sawstop-steve-gass-patent-cost Planet Money https://www.planetmoneybook.com/ https://n.pr/3HlREPz Play the new version of our game here. Version 4. https://www.npr.org/sections/planet-money/2025/10/02/g-s1-89913/how-you-can-play-and-improve-the-planet-money-game http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

On the eve of Netflix shoveling a fourish-hour chunk of Stranger Things onto Christmas Day, we visit the past, present, and future of binge-dropped television shows. The strategy of releasing an entire season at the same time has been key to taking Netflix from a little startup that used to lend us DVDs in the mail … to a company so big and powerful, it is maybe going to buy Warner Brothers and own Bugs Bunny and Tony Soprano and the Harry Potter movies. But even Netflix may be flirting with some slightly less binge-y models of content release. Are we entering … the end of the binge drop? On our latest: what data tells us about binge watching. Was it the greatest business decision, and who does binge watching really benefit? Here’s some of the research https://download.ssrn.com/23/03/01/ssrn_id4373813_code1593749.pdf?response-content-disposition=inline&X-Amz-Security-Token=IQoJb3JpZ2luX2VjENH%2F%2F%2F%2F%2F%2F%2F%2F%2F%2FwEaCXVzLWVhc3QtMSJIMEYCIQDzzLmfGFdOBtH7wci6mImPL%2BreVCnKQbkf738IX7%2BtcAIhAN%2FhkEToIQ0awDa8jlL3%2FDjwohSdYtxz3O4ZjvCVjF1lKsUFCJn%2F%2F%2F%2F%2F%2F%2F%2F%2F%2FwEQBBoMMzA4NDc1MzAxMjU3Igy7UMZFnabJwvhU8hsqmQWvHbpFeaQwYWFMScQBGF%2FQbta0iHOmnmHlbYWiBMIk3sCEzac33rU8J8j9kpe1SVCkXtGDGdkwFXqbpkBySKgvN%2FIdGP4EXGcnuR%2BN9tysv3lxOBI%2BdqjAr1KjexqOWNC8kDSuCkc5DOfHyoZZxLVRTC50N%2BkkmXuV6UHTfv4NWZUzU%2F4GIxkkHMkfsfoaXQBRixoVfHO9vbFcRiciZARFQVxUzym8%2BEnUmB0%2FU0dFWGYFu%2BvXhC1NZNZbNSFblu5n6FKtjDyQ%2BcFhz6UzvWMbbPJLHBvY6Ack4h%2FVaE4vFl%2FE6byflSIAqlkY05P4%2BQO%2BtZVVa3UFc3Ak2SkghpGz9Td5aXU33gKs0jCVuRS6kO%2BgBhkaLz591bxojzOiGhkp4gpjl3oxsHbsoAi8kczxaZ4E1wdf9nuqmt%2BNksgtJXlQ2jmmXPaiKE%2Bi14ZhdIjb43sL8CxKfNPb7w3o0Ia%2FDbSjmlYVscov9Bg%2FwPmzrhO2%2BLrNTyEDYPF0kK8lnmcQ2pXt57n%2BzzlFVvFF46I6uLQAR%2B0K6CqcfRad9VLce6Z4Pi7NXFUJPpPBGA0PRbhQpBsYhEv5aS1WPZK00VTPjkYdKfpp5%2FmQEZBRaXSkbxz29VwcPmTXq9CArtLnRjeu0hj70Q8J%2FeW%2BpxHOiq%2BYJ6uUWr7pVAiMtV2Y8t22HWJn3veTYWFODan8GVDzgkpOf5FqBtKFAZica83ELUpO4UW76shoenilmCkCLzCmKxg0fdqFgMIQYgTwPDVP7%2B2i4yiprY7UYJMQ6GjhPQPQXRFoZG6wXLjn1B1WjldJ7Tb1%2F6UjwUNg602XkCkieEwtaRc%2BefQbPXvLXPyAEalt3PyYwKnzrEIFwAHrxFwKjcI%2Ffw9MDm%2FwQjCY0ZDKBjqwAaLXJ5NdUoFBx%2FOI4UpDmNEiamtrGtQpSfZezPcY4imBEh0nS7ExtGDwpvcXMA7hIbKotNehffJXJgNodOCj8iQp2%2F6PI8Ncqm4l%2BRZwYeD490JY%2FtdoAzNgQcAnCCVythev2ksn%2Bhz1omuyJ%2FI5uy%2BPaxM2QG%2BWM3rdy8AbWGXlKc6sm3r9cZ4oMn%2BqfQtpM1FqAyDsYVY0U7mLpYClrrASgIiCFhpTjZ3ry2NDUBdq&X-Amz-Algorithm=AWS4-HMAC-SHA256&X-Amz-Date=20251218T172431Z&X-Amz-SignedHeaders=host&X-Amz-Expires=300&X-Amz-Credential=ASIAUPUUPRWE7RLY7ZW3%2F20251218%2Fus-east-1%2Fs3%2Faws4_request&X-Amz-Signature=87fec993748412ff29349361e5d76f0196586f5cab6374fb93c9427e8275ef6b&abstractId=4352446. https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

As a country, we are spending more to get data centers up and running than we spent to build the entire interstate highway system. (Yes, that’s inflation-adjusted.) With tech companies spending hundreds of billions of dollars on AI, data centers have kind of become thing in the US economy. But along with that growth have come a lot of questions. Like where is all the electricity to run these data centers supposed to come from? And how much are residential customers’ electric bills increasing as a result? On today’s episode, we go to Ohio to trace one electric bill back to its source, to see what exactly is causing the big price increases people are seeing. We take a tour of a data center hot spot, and get to the bottom of how prices are set from inside the power company. Related episodes: - Asking for a friend … which jobs are safe from AI? https://www.npr.org/2025/09/10/nx-s1-5534485/ai-onet-jobs-safe-list - No AI data centers in my backyard! https://www.npr.org/2025/10/22/nx-s1-5581445/no-ai-data-centers-in-my-backyard - What $10 billion in data centers actually gets you https://www.npr.org/2025/04/02/1242229718/ai-mississippi-jobs-data-centers-virginia - Is AI overrated or underrated? https://www.npr.org/2024/09/11/1198748511/is-ai-overrated-or-underrated - Green energy gridlock https://www.npr.org/2023/05/16/1176462647/green-energy-transmission-queue-power-grid-wind-solar https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Planet Money Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Welcome to the inaugural Pop Culture Draft! In today's episode (a episode we’re releasing into the main feed) we're gonna go back to the year 1999. Three hosts, Kenny Malone, Wailin Wong, and Jeff Guo, go head to head and each drafts a “team” of economic pop culture. So a movie, a song, and a wild card pick that best represents the spirit! It could be a movie related to business or maybe a song about money … as long as it came out in 1999! Listen to hear each of them make the case for why their team should be crowned the winner! If you want more bonus episodes like this one and to support our work, sign up for https://n.pr/3HlREPz. http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Planet Money’s Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

In 2008, Chicago’s budget was in a bad place. The city needed money. One way to raise money was to increase property taxes, but what politician wants to do that? So instead, Mayor Richard M. Daley’s administration looked around at the resources the city had, and thought, ‘Any of this worth anything?’ They opted to lease out the city’s metered parking system — to privatize all 36,000 of its parking meters. The plan: have private companies bid on operating the meters, modernizing the system, and keeping the profits for a certain number of years. In exchange, they would give Chicago a big lump sum payment. The winning bid was $1.16 billion dollars for a 75-year lease. Today’s episode is the story of how that bid got put together, and how it came to be hated. There are kidnapped parking meters https://www.npr.org/sections/thetwo-way/2010/10/25/130811940/chicago-s-new-parking-meters-go-missing-tears-are-not-shed, foot chases through City Hall, and trashbags filled with secret documents. Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

From nuclear fission to GPS to the internet, it’s common knowledge that many of the most resource intensive technologies of the last century got their start as military R&D projects in government-funded labs. But as Avery Trufelman explains in her fashion history podcast, https://articlesofinterest.substack.com/p/gear-chapter-1, the influence of the US military is, in many ways, even more intimate than that, shaping much of the clothing we all wear everyday. On today’s show, a tale of Army surplus economics. How military designs trickled down from the soldiers on the front lines to the hippies on the war protest line to the yuppies in line at Banana Republic. And why some of your favorite outdoor brands may just be moonlighting as U.S. military suppliers, while keeping it as under the radar as they can. https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Planet MoneyPlanet Money Articles of Interest Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

A few years ago, the Jamaican government started making an unusual financial bet. It went to investors around the world asking if they'd like to wager on the chances a major hurricane would hit the island in the next couple of years. In finance terms, these kinds of wagers are called "catastrophe bonds." They're a way to get investors to share the risk of a major disaster, whether that's a Japanese earthquake, a California wildfire, or a Jamaican hurricane. This market for catastrophe has gotten really hot lately. And it’s changing the way that insurance works for all of us. Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

http://npr.org/peopleschoice AI is already reshaping how people find work. Fewer entry-level jobs, robot recruiters, and ever-changing new skill requirements all add up to a new, daunting landscape for humans trying to find dignified work. Today on the show: two stories from the edges of a changing labor market. First we’ll assess claims that AI is causing a white collar job apocalypse. What does the data actually say? We meet an economist who has found one small but fascinating way to measure the impact of AI on workers. Then, we go face-to-face, or at least voice-to-voice, with AI. We meet a robot recruiter for a job interview and find cause to ask, ‘When might that actually be preferable to a human recruiter?’ https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Indicator Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Taylor Swift reaches new heights with her latest album, which is both divisive and record-breaking. And it’s fueled by an elaborate series of business choices that propel profits but also chart numbers. Today’s episode comes from our friends at https://www.vox.com/today-explained-podcast, Vox’s lively, smart daily news podcast. Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Givewell is a nonprofit organization that gives money to “save or improve the most lives per dollar.” Part of their whole thing is a rigorous research process with copious and specific datapoints. So, in the chaotic wake of USAID’s gutting, they scrambled to figure out if they could fund the kind of projects USAID used to. Today on the show: GiveWell let us in on their decision-making process, as they try to reconcile the urgency of the moment with their normal diligence. We get to watch as they decide if they can back one project, to support health facilities in Cameroon. https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB Planet Money Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Wherever consumer sentiment goes, consumer spending usually goes too. They’re like buddies that do everything together. Consumer sentiment wants a hair cut, its buddy consumer spending does too.But lately, these friends are drifting apart.While consumer sentiment about the economy is down … spending remains strong. And not just that… Interest rates are still high, inflation is growing, tariffs have made the prices of goods go up. And yet, consumer spending looks good. What gives?Today - a consumer spending mystery. Is the economy actually healthy? Or is something distorting our view of the economy? Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy

Tariffs. They’ve been announced, unannounced, re-announced, raised and lowered. It’s an on-going saga with billions at stake! On today’s episode, we run full-on at the twisty, turny drama of life with broad-based tariffs and tackle perhaps our most asked question: Are we, regular U.S. shoppers, feeling the tariffs yet? When we’re at the grocery store or the coffee shop, are we paying more for things because of the tariffs? We now have the data to get a very clear answer to that question. Plus, we hear a cautionary tale from our dear colleague James Sneed, who ordered a collectible doll and wound up with a surprise tariff bill at his door. __ __ https://www.planetmoneybook.com/ https://n.pr/3HlREPz http://n.pr/PM-digital https://n.pr/3gTkQlR https://n.pr/3Bkb17W https://n.pr/3h92GwS https://n.pr/3FqLuws https://n.pr/3sGZdrq https://n.pr/3zrFvUB This episode was produced by Willa Rubin and edited by Jess Jiang. It was fact-checked by Sierra Juarez with research help from Vito Emanuel. It was engineered by Jimmy Keeley and Maggie Luthar. Alex Goldmark is our executive producer. Music: NPR Source Audio - “Mirror,” “Remorse,” “Endless,” “Secrets,” “Schmaltzy,” “Water Mirror.” Learn more about sponsor message choices: podcastchoices.com/adchoices https://podcastchoices.com/adchoices NPR Privacy Policy https://www.npr.org/about-npr/179878450/privacy-policy